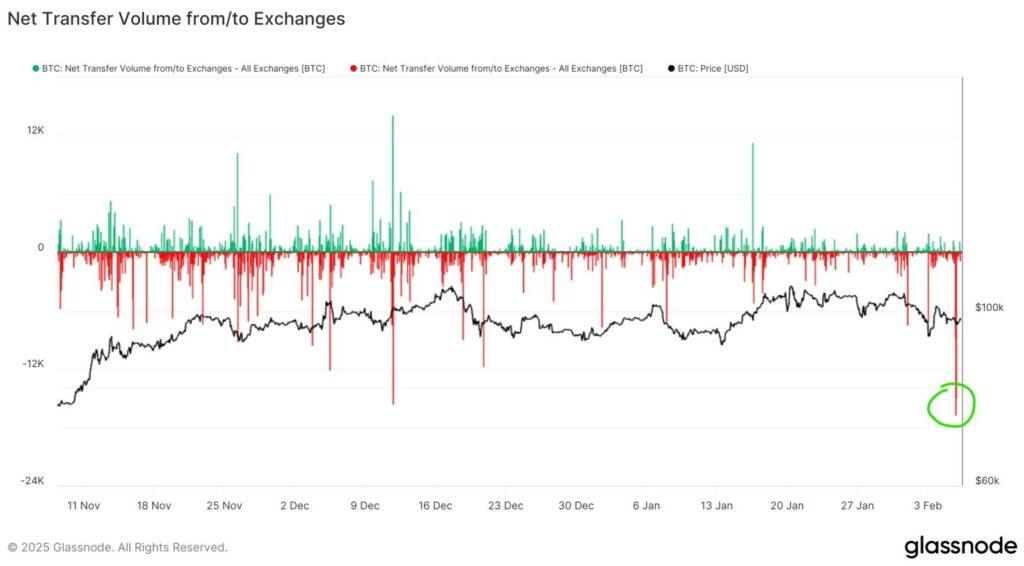

On Wednesday, centralized exchanges registered a net exit of more than 17,000 BTC, with a value of more than $ 1.6 billion at the current market price of $ 98,600, according to Glassnode data shared by Andrew Dragosch, head of research to Bitwise .

That is the greatest exodus of single -day coins since April 2024.

“The whales are buying this fall,” Dragosch said in X, referring to the large coin exit. Investors generally take direct custody of the coins when they plan to keep them in the long term. Therefore, a great exchanges output is taken to represent a bullish feeling.

Keep in mind that blockchain data, although widely used to evaluate market conditions, may be biased by internal wallet transfers by exchanges.

Coinbase alone prosecuted net retreats of more than 15,000 BTC, by Dragosch. Timechainindex.com’s analysis shows that Coinbase divided four directions on Wednesday that totals more than 20k BTC in 60 addresses, which suggests a possible important purchase by ETF or Microstrategy this week.

The data in the chain compiled by Cryptoquant shows that all cryptography exchanges had a 47K BTC cumulative network on Wednesday, with 15.8k of that attributed to Coinbase.

Bitcoin fell below $ 96,800 during the US negotiation hours. Make your first investment in Bitcoin.