By Francisco Rodrigues (All Times et unless indicated otherwise)

Although Bitcoin (BTC) has changed little in the last 24 hours, only 0.7%, the broader market is of a bearish humor after the Token De Libra debacle, which has led to accusations of fraud and demands The dismissal of the president of Argentina, Javier Milei ,.

The Coendesk 20 index has dropped around 2.3% on last day, and the medium -term market movement probably depends on how Russia’s negotiations go in the United States in Riyadh. The conversations focus not only on the end of the conflict in Ukraine, but also on the “normalization” of ties between countries.

An additional uncertainty layer comes from FTX digital markets, the FTX subsidiary based in Bahamas, which begins to pay the creditors today. In total, the FTX refund program will be around $ 16 billion.

The liquidity injection will come in the form of stablecoins. First there are creditors with claims below $ 50,000, which will receive approximately 119% of their claimed claim, with a 9% annual interest accumulated since November 2022.

The effect that payments will have is not clear. While some analysts say that the amount that is reimbursed is now “too small to move the needle,” others suggest that FTX’s historical interest in the Solana ecosystem means that some of these funds will flow towards it.

Investors have recently directed their attention to Ether. The ETF Spot that offer exposure to the second largest cryptocurrency for market capitalization are seeing an accumulated net ticket of $ 393 million this month. That compares with a net exit of $ 376 million for ETF Spot Bitcoin.

These entries are presented in front of Ethereum’s sicking update that enters its test phase at the Holesky Testnet. Pin should bring a series of improvements to scalability and safety and allow users to pay gas rates with different Ether tokens.

In other places, individual investors are bassists in the midst of commercial war threats, reduction in interest reduction expectations and consistent inflationary surprises. A survey by the American Association of Individual Investors found that the courage among investors is in a maximum of two years, reports the Wall Street Journal.

This pessimism, however, is often an opposite indicator. The risk appetite of institutional investors has also decreased this month on the possible effects of a possible commercial war in the probabilities of decreasing a Fed rate cut. Stay alert!

What to see

- Crypto:

- Macro

- February 18, 10:20 am: The president and executive director of the Fed of San Francisco, Mary C. Daly, pronounces a speech in Phoenix. Live broadcast link.

- February 18, 1:00 PM: Michael S. Baro de la Fed, vice president of supervision, gives a speech entitled “Artificial Intelligence in the economy and financial stability” in New York. Live broadcast link.

- February 19, 2:00 pm: The FED launches minutes of the FOMC meeting from January 28 to 29.

- Earnings

- February 18: Coinshares International (CS), before the market

- February 18: Semler Scientific (SMLR), Post-Market

- February 20: Block (XYZ), Post-Market, $ 0.88

- February 24: riot platforms (Riot), post -market, $ -0.18

- February 25: Bitdeer Technologies Group (BTDR), Pre -Mercado, $ -0.53

- February 25: encryption mining (encryption), pre -market, $ -0.09

- February 26: Mara Holdings (Mara), Post -Mercado, $ -0.13

Token events

- Governance

- You unlock

- February 21: Rapid Token (FTN) to unlock 4.66% of the circulating offer worth $ 78.6 million.

- February 28: Optimism (OP) to unlock 1.92% of the circulating offer worth $ 34.23 million.

- Lanza Token

- February 18: Ethena (ENA) will be listed in Arkham.

- February 18: Ronin (Ron) that will be listed in Kucoin

Conferences:

Coindesk’s consensus will be carried out in Hong Kong from February 18 to 20 and in Toronto from May 14 to 16. Use the code code and save 15% in passes.

Token talk

By Francisco Rodrigues

- Donald Trump’s supporters will receive around $ 50 in official Trump tokens if they bought goods from the websites associated with the president of the United States.

- The Token was presented a few days before Trump assumed the position and has lost more than 70% of its value since then.

- The decentralized exchange with headquarters in Solana Jupiter has begun to accumulate USDC using 50% of the protocol rates collected to buy tokens JUP. The repurchases have not started yet.

- The JUP price has dropped more than 12% in the last 24 hours on the protocol apparent participation In the libra cryptocurrency debacle.

Derivative positioning

- The sun’s price can continue to fall, since the open interest of perpetual future has increased by 5% in the last 24 hours, accompanied by a delta of negative cumulative volume (CVD). This combination indicates net sale pressure in the market.

- The CVD for most main tokens is negative, indicating a bassist feeling.

- BTC and ETH short -term front stalls continue to be more expensive than calls in Delibit. The feeling is optimistic after the expiration of February.

- The block flows presented an expansion of Bitcoin Bull of April, which involves $ 85k and $ 100K and long strikes in the $ 94K and $ 90K strikes. Ether Bull Call Esprads also crossed the tape.

Market movements:

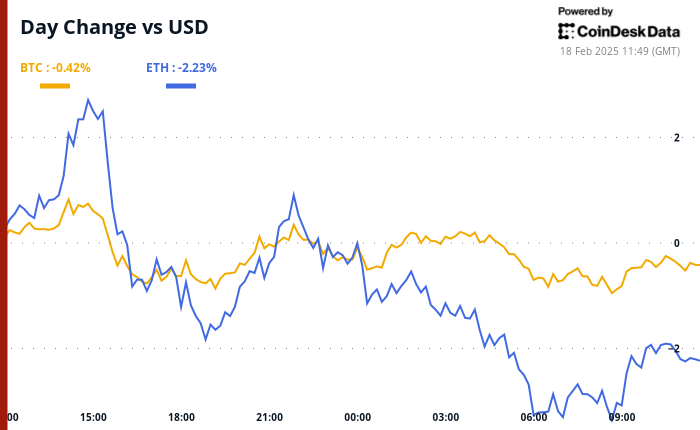

- BTC fell 0.69% of 4 pm et on Monday to $ 95,802.76 (24 hours: -0.57%)

- ETH has dropped 2.88% to $ 2,698.31 (24 hours: -1.89%)

- COINDESK 20 has dropped 2.23% to 3,161.95 (24 hours: -3.03%)

- The commitment rate composed of Ether increases 27 bp to 3.18%

- The BTC financing rate is at 0.0078% (8,5541 annualized) in Binance

- DXY has risen 0.36% to 106.94

- Gold has increased 0.97% to $ 2,922.9/oz

- La Plata rises 0.70% to $ 32.99/Oz

- Nikkei 225 closed 0.25% to 39,270.4

- Hang Seng closed +1.59% to 22,976.81

- Ftse has risen 0.18% to 8,783.43

- Euro Stoxx 50 does not change to 5,520.7

- Djia closed on Friday -0.37% to 44,546.08

- S&P 500 closed without changes at 6,114.63

- Nasdaq closed +0.41% at 20,026.77

- S&P/TSX Compiete Index Closed -0.84% at 25,483.2

- S&P 40 Latina America closed +2.12% at 2,490.30

- The 10 -year Treasury rate of US

- E-mini s & p 500 futures rose 0.1% to 6,151.5

- E-mini nasdaq-100 futures have increased 0.21% to 22,282

- E-mini dow Jones The industrial average index index has dropped 0.15% to 44,676

Bitcoin statistics:

- BTC domain: 61.17 (0.85%)

- Ethereum ratio A Bitcoin: 0.02813 (-1.71%)

- Hashrat (seven -day mobile): 790 eh/s

- Hashprice (spot): $ 53.47

- Total rates: 6.93 BTC / $ 663,706

- CME Future Open Interest: 174,200 BTC

- BTC with a gold price: 32.8 oz

- BTC vs Gold Market Cap: 9.31%

Technical analysis

- The picture shows the mastery of the Tether USDT market, the largest stablecoin stable.

- Its domain rate seems to have bounced on the decline in March 2024, causing a double bullish background pattern.

- In other words, the USDT could become more dominant, which generally occurs during price corrections throughout the market.

Cryptographic equities

- Microstrategy (Mstr): closed on Friday at $ 337,73 (+3.94%), 0.6% less than $ 335.76 in the previous market.

- Global Coinbase (Coin): Closed at $ 274.31 (-7.98%)

- Galaxy Digital Holdings (GLXY): closed at C $ 27.65 (-2.54%)

- Mara Holdings (Mara): Closed at $ 16.90 (-0.06%)

- Riot platforms (Riot): closed at $ 12.27 (+0.33%)

- Core Scientific (Corz): Closed at $ 12.51 (-0.24%)

- CleanSTark (CLSK): closed at $ 10.50 (-1.59%)

- COINSHARES VALKYRIE BITCOIN MINERS ETF (WGMI): closed at $ 23.40 (+0.52%)

- Semler Scientific (SMLR): closed at $ 49.67 (+0.44%)

- Exodus movement (exod): closed at $ 50.00 (unchanged)

ETF flows

The data below are from February 14. American markets were closed on February 17.

Spot BTC ETF:

- Daily net flow: $ 70.6 million

- Cumulative net flows: $ 40.12 billion

- Total BTC holdings ~ 1,180 million.

Spot Eth Ethfs

- Daily net flow: $ 11.7 million

- Cumulative net flows: $ 3.15 billion

- Total eth holdings ~ 3,791 million.

Source: Farside Investors

Flows during the night

Figure of the day

- Although Bitcoin remains apathetic below $ 100,000, Nasdaq 100 Wall Street technology has skipped near the maximum record.

- If BTC’s positive historical correlation with technological actions is a guide, BTC could soon obtain a solid offer.

While you sleep

In the ether