The XRP cryptocurrency centered on payments is decreasing but it was not, while the perspectives for Dogecoin (Doge) appear bleak, according to an analysis of the fibonacci setback levels.

XRP reached a peak of $ 3.40 in mid -January and since then it has entered a bearish trend, with the price falling 25% this month to $ 2.28, according to TrainingView and Coindesk data.

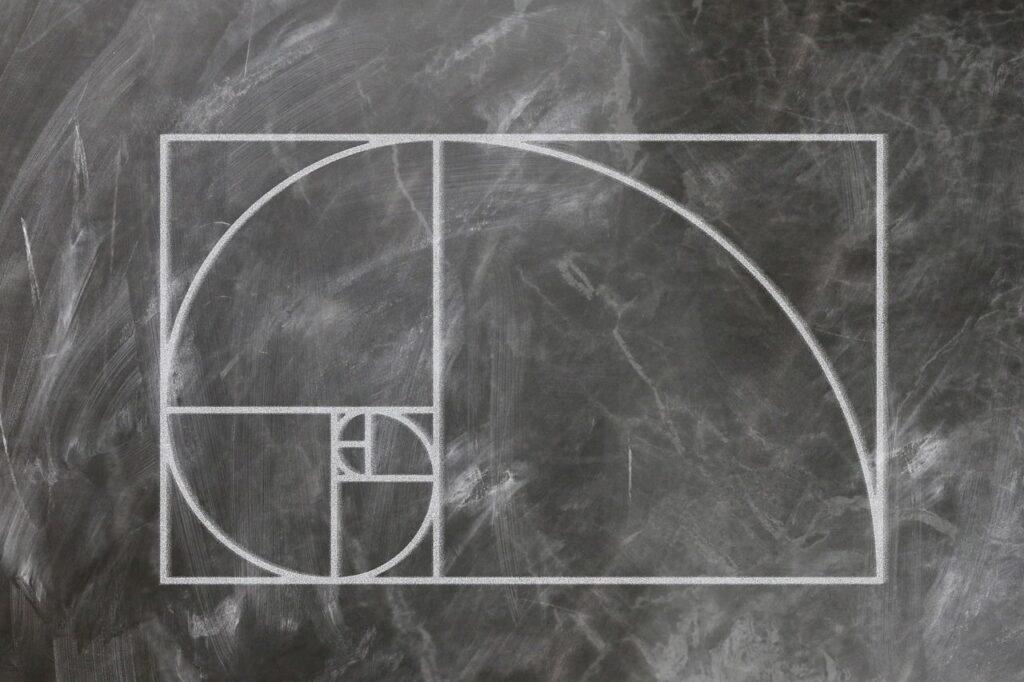

Although the mass sale has been steep, it corresponds only to a fibonacci setback of 38.2% of the demonstration that began at least November 4, 49.5 cents to the maximum of January 16, $ 3.40. A setback is a fall of the main trend.

That is positive news for XRP bulls, since that level, together with the proportions of 50% and 61.8%, indicates potential areas for the price to resume its previous trend, according to the CME explanator.

Trends often return to these levels before starting larger manifestations. That means that XRP bulls have reasons to be optimistic about possible profits ahead.

In addition, there has been a positive news flow with respect to XRP recently. On Monday, ETF.com said the Brazilian Securities Regulator had registered the first SPOT XRP Circa (ETF) Fund since the Nasdaq XRP Hashdex Fund entered a so -called preoperational phase with Brazil’s Commission of Mobiliários Values (CVM).

US regulators are also reviewing applications for ETF XRP. A possible approval could accelerate the institutional demand of XRP if the absorption of Bitcoin (BTC) and ETF ETH (ETH) is a guide.

The Fibonacci series includes adding the two previous numbers to find the following number. The sequence, which has been of interest to mathematicians and scientists for centuries, occurs as follows: 1, 3, 5, 13, 21, 34, 55, etc. The ratio of any number for the next higher number is close to 0.618 and if you divide any number into the sequence of the two spaces to the right, it obtains 38.2.

Operators use these proportions and the 50% level to predict to what extent an asset could return to the main trend, in the case of XRP, the execution of the bull.

It is a different story for Dogecoin because it is considered that a main trend ends when a setback exceeds the level of 61.8%.

The largest memes cryptocurrency in the world by market value has fallen below 21 cents, returning to more than 70% of the demonstration marked by the minimum of October about 10 cents and a maximum of 48.4 cents in December.