As the price of Bitcoin (BTC) is reduced, merchants in Crypto Exchange Bitfinex are up to their reputation for being immersion buyers, offering some hope to the battered cryptographic bulls given their history of predicting the peaks and channels of the market.

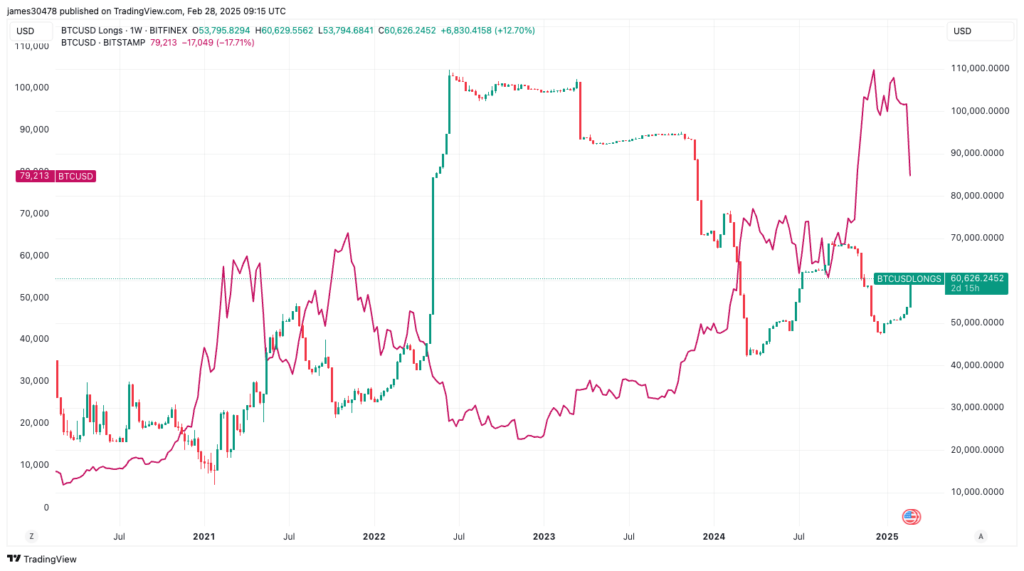

The bitcoin number purchased in Bitfinex with borrowed cash, a commitment that the BTC price will increase and leave the investor with profits once they have paid the loan, has increased to more than 60,000 BTC of 50,773 this month. 2% has been skipped in the last 24 hours alone, according to Coinglass and TrainingView data.

The increase in the so -called long margin positions is a vote of confidence in the largest cryptocurrency, which has lost more than 20% this month and is on its way to its worst monthly performance since June 2022.

Bitfinex merchants are mainly whales, or holders of large amounts of Bitcoin, which are incorporated with long margin. They are known to precisely pointing to Bitcoin’s tops and funds and tend to accumulate during low trends or control markets, as they did in the middle of last year.

Looking at a five -year time frame, margin lengths have constantly increased holdings during price groups and reduced exposure near market peaks. This pattern was evident during the market tops 2021 and 2024.

As the cryptographic market falls, the feeling of the cryptography market is in a state of extreme fear, according to the Coinglass crypto and greed index. During the past year, the market has only seen four days of extreme fear. It has been dominated by greed and extreme greed for more than 230 days.