XRP is taking a bull respite one day after Donald Trump seemed plans for a strategic files reserve together with Bitcoin (BTC), Ethher (Eth), Cardano (ADA) and Solana (Sun).

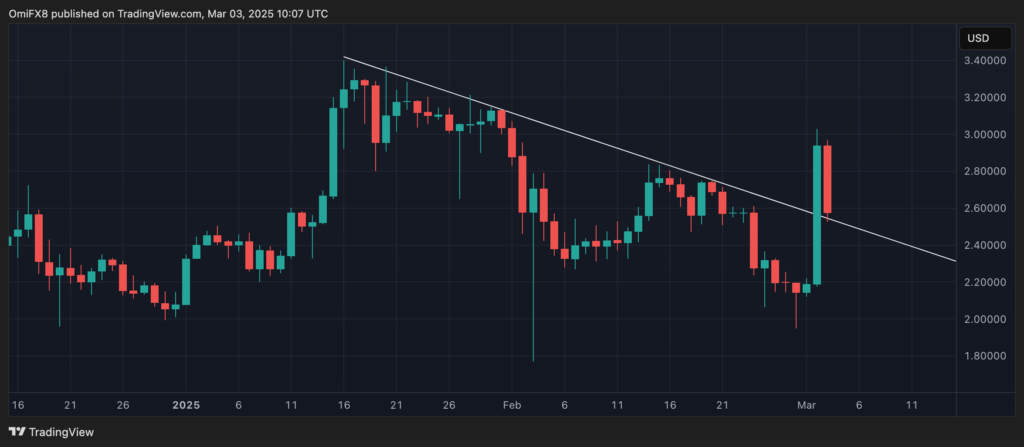

The cryptocurrency centered on payments was recovered from 25% within a few hours of Trump Social Social position, reaching $ 3, but since then it has been withdrawn to $ 2.6 at the time of publication. Prices have retired to the line of descending trend since the maximum of January 16.

Among the technical indicators, the relative resistance index (RSI), which measures whether the price moves too fast, increased to 70 Sunday night and has returned to 48 of the readings greater than 70 or overcompra observed on Sunday night, indicating a potential for a higher renewed movement.

However, prices remain below the 50 -hour SMA ($ 2.65), indicating weakness, while the broader SMA of 200 hours ($ 2.50) admits that it remains intact.

The hour of divergence of the convergence of the mobile average shows impulse changes: its line line below the signal at $ 3 (now below zero) confirms a bearish turn after the rally.

Key levels

Bollinger’s bands of 20 hours, which define a price range, show $ 2.9 such as the upper limit and $ 2.4 as lower, and with prices of $ 2.6 in the middle, indicates a reduced volatility after the previous peak.

The Rally at $ 3 exhausted the purchase pressure with RSI in 70 and a MacD crossover, which supports a setback. The 50 -hour SMA violation reflects a short -term bearish control, but the 200 -hour SMA at $ 2.5 is a critical support.

The current price ($ 2.62) is in a pivot: a break below $ 2.50 the risks decrease even more, while a movement above $ 2.65 could be directed at the level of $ 3 and higher. The impulse favors them in the short term, and speculators could observe the volume and a decisive movement for additional positioning.