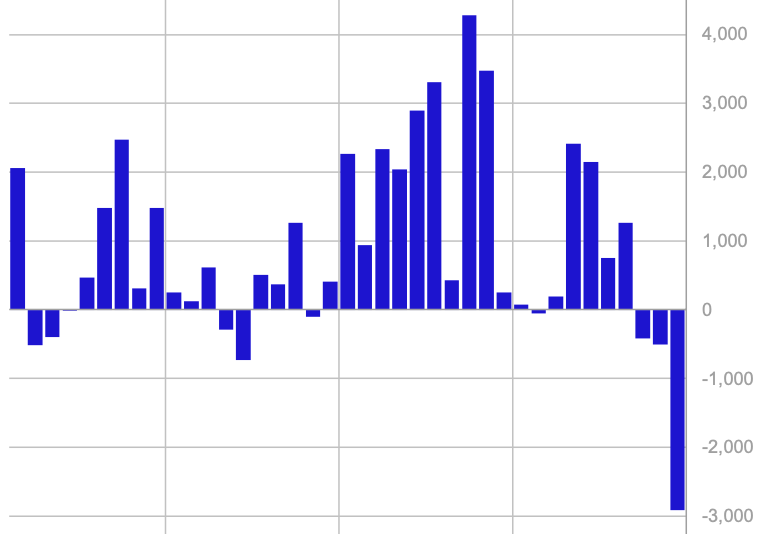

The products criticized in exchange (ETP) suffered their largest weekly sale in the registry, with investors withdrawing approximately $ 2.9 billion of these funds, according to a Coinshares report published Monday.

Mass exits mark a significant change in feeling after a prolonged period of constant investment in digital asset products.

This last wave of retreats extended a three -week exit streak, now totaling $ 3.8 billion. The Coinshares research analyst James Butterfill, said several factors that probably drive the liquidations, including the growing concern of investors after the recent trick of $ 1.5 billion in Crypto Exchange Bybit and the increasingly aggressor position of the Federal Reserve about monetary policy.

Before this recession, cryptographic investment products had enjoyed 19 consecutive tickets, which suggests that some investors were blocking profits in the midst of the growing uncertainty of the market.

Bitcoin (BTC), the largest cryptocurrency for market capitalization, took the worst part of the departures, losing $ 2.6 billion during the past week. Meanwhile, the funds that are bet on Bitcoin, known as ETP of Bitcoin short, only saw a modest entry of $ 2.3 million, indicating that the bassist feeling has not yet been completely seized.

While most assets fought, some stole the trend: Sui (SUI) emerged as the best performance with $ 15.5 million in tickets, followed by XRP (XRP), which also attracted a new investment.

Spot Bitcoin ETF faced one of its most difficult weeks so far, with investors taking out significant capital of these funds. Ishares Bitcoin Trust (ibit) of Blackrock, the largest of its kind, recorded an amazing amount of $ 1.3 billion in exits, according to Coinshares, the highest weekly retreat since its launch.

Similarly, the open interest of Bitcoin CME futures fell sharply in the last two weeks, falling from 170,000 BTC to 140,000 BTC, indicating a possible change in institutional positioning. At the same time, the continuous annualized base of three -month futures is producing 7%, only a little higher than the 4% yield offered by the United States Treasury Bonds in the short term, which makes trade less attractive to investors.

“This tells me that the coverage funds are beginning to relax their basic commercial position, which is a neutral position in the network,” said James Van Straten, Coindesk analyst. “With an extension of narrowing between the yields of the futures and the yields without risks, the merchants may be reassessing capital away from those derivatives of Bitcoin in favor of safer and safeer assets.”

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.