The cryptographic market seems to have stabilized, however, merchants continue with caution while it comes to Altcoins, such as XRP, while continuing money in the Bitcoin market leader (BTC).

XRP centered on payments, which Ripple uses to facilitate cross -border payments, has increased more than 3% to $ 2.24 in the last 24 hours mainly with the hope that the legal battle between Blockchain Company Ripple and the Bag and Securities Commission (SEC) can conclude soon.

Amid the price increase, the cumulative open interest in perpetual future listed in the main exchanges has stabilized about 1.35 billion XRP, with annualized financing rates and the delta printing of negative cumulative volume, according to the veil data source.

Negative financing rates mean that shorts are paying targets to keep their bassist bets open. It shows the mastery of short bassist positions in the market. The delta of the negative cumulative volume, which measures net capital inputs in the market, indicates that the sale of volume has accumulated more than the purchase volume, which can indicate a bearish trend.

Both indicators, therefore, question if the increase in XRP prices has legs. At the time of publication, several other tokens of great capitalization such as Doge, Sol, Sui, Hbar, LTC, BTC, TRX and HYPE had negative CVDs based on 24 hours.

Speaking of Dux, the simple mobile average (SMA) of the price of the token is about to cross below the 200 -day SMA, confirming the so -called cross of death. The sinister sound pattern indicates that the impulse of the short -term price now has a lower performance than the long -term impulse, with the potential to evolve to an important bearish trend.

These SMA crossovers are widely followed by trends merchants, which means that the confirmation of the death cross could provide more sale pressure to the market. That said, the long -term SMA crossovers are lagged indicators, which reflects the mass sale that has already materialized and has a mixed record of predicting price movements in the BTC and ETH markets.

Keep in mind that Dege has already fallen 65% since it reached its maximum point in more than 48 cents in December.

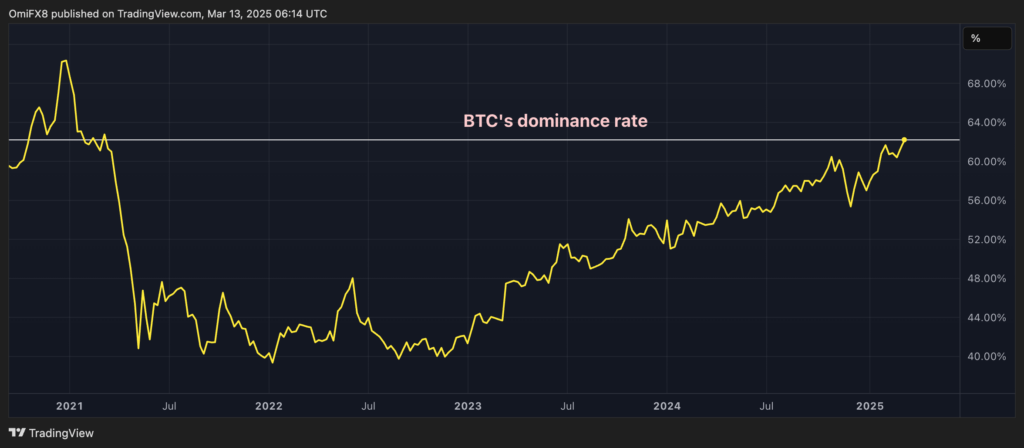

More dominant BTC in four years

The Bitcoin domain rate, or the participation of cryptocurrency in total market capitalization, has increased to 62.5%, the highest since March 2021, according to the commercial source of the data source.

In particular, the metric has increased from 55% to more than 62% since the total capitalization of the market crypto reached a maximum of $ 3.6 billion in December.

It means a continuous preference for BTC, particularly during the broader recessions of the market.