Bitcoin (BTC) continued to fight on Thursday, since he fought to stay above $ 80,000. The largest cryptocurrency for market capitalization has currently dropped 3% in the day. It has decreased 13% in the first quarter and has approximately 30% discount to its historical maximum as of January.

According to Glassnode data, short -term holders, investors who have maintained Bitcoin for less than 155 days, are considered mainly speculators that tend to enter the market during price peaks or periods of the euphoria of the market. Since February, more than 100,000 BTC have sold (around $ 8 billion at current prices), a signal that seeks to reduce losses (or block any gain) before prices fall even more.

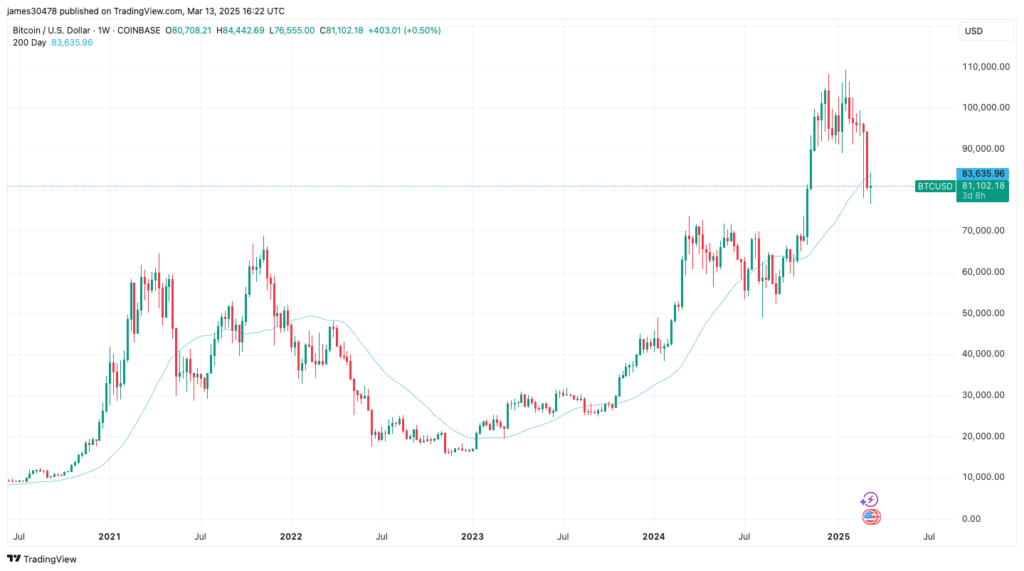

The decrease has promoted the price of Bitcoin below its 200 -day mobile average of $ 86,300. The average is an important metric for long -term market trends, and BTC is not the only risk investment that must fall below.

US actions, measured by S&P 500, have also lost that level. The index is currently around 5,537, while the 200 -day average is 5.738.

According to Joe Carlase, a commercial litigator that supports Bitcoin, when the S&P 500 struggles to claim 200-DMA, the story suggests that the lowest prices are in sight.

“The S&P 500 continues to fight to recover the 200 days,” he wrote in X. “If we cannot get a great rally above it soon, it makes sense to wait for the lowest prices to look historically what happens when we lose the 200 days.”