The stablecoin protocol level increased a new risk of risk capital to expand its stable of $ 80 million that pays the yield, since the offers of digital assets generating performance are increasingly demanded with a reuse time in cryptographic prices.

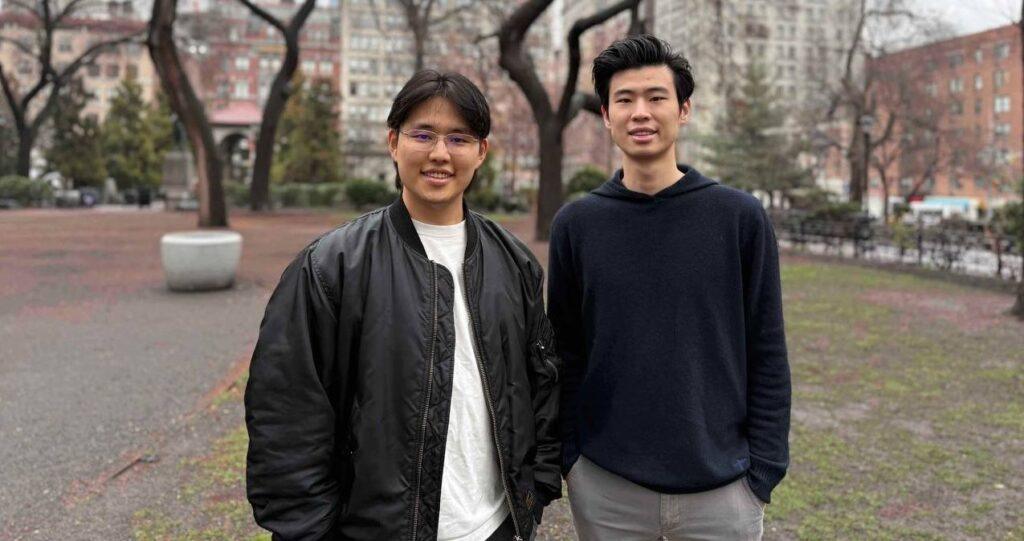

Peregrine Exploration, the development firm behind Level, received another $ 2.6 million led by the early capital of the capital of dragonflies with Polychain also participating, the founders David Lee and Kedian Sun told Coindesk in an interview. The new investors include Flowdesk, Echo Native and collective Cryptographic Union fighter for Path, and Angels Sam Kazemian investors of Frax and Albert Chon of injective.

The last round followed an increase of $ 3.4 million in August, which carries the total financing of risk capital to $ 6 million to date.

The level, with its token LVLUSD, is competing in the rapidly growing Stablecoin asset class, one of the most popular Crypto sectors and a favorite among risk capital investments. Stablecoins, crystals with a fixed price, predominantly linked to the US dollar) are a key piece of infrastructure for trade and blockchains transactions. However, the largest issuing issues generally do not offer performance to users won in assets in the backup reserve. Tether, for example, reported earnings of $ 13 billion last year, partly the treasure yield of the United States that supports its token of $ 143 billion dollars.

That is why a new generation of performance performance performance is becoming increasingly popular among cryptographic investors. The USDE of Ethena, which generates a yield in a commercial neutral market transport strategy in the market, the harvest of futures financing rates, extended to an offer of more than $ 5 billion in just over a year. Meanwhile, the tokenized versions of the money market funds and the Treasury invoices, another Stablecoin alternative, reached a market capitalization of $ 4.6 billion.

Level Stablecoin offers investors performance by putting backup assets to work for decentralized finance loans (defi) as AVE, while automating its reserve administration. Users can accommodate LVUSD depositing the USDC or USDT stable and block (stake) tokens to provide to generate the chain performance. From last week, the annualized yield for the staked version of LVLUSD stood at 8.3%, higher than the yields of the tokenized money market funds. Meanwhile, Lvlusd has been integrated with Defi protocols such as Pendle, Spectra and Layerzero, and can be used as a collateral in Morpho.

“His completely chain and transparent approach to generate the difference of competitors that depend on opaque and centralized methods,” said Polychain Sven Wellmann, one of the investors in the protocol.

According to Level’s calculation, the protocol exceeded Stablecoins rival yield offers during the past month, which has helped its offer to exceed $ 80 million in five months since its beta launch.

With the last financing, Level plans to expand his team and marketing efforts while continuing to expand the utility for LVLUSD beyond rethinking it, Kedian Sun explained. The protocol also plans to take advantage of Morfo to generate performance in the coming weeks.

With those efforts, LVUSD could boost a market capitalization of $ 200- $ 250 million, a key milestone that the team wants to achieve, said Sun.