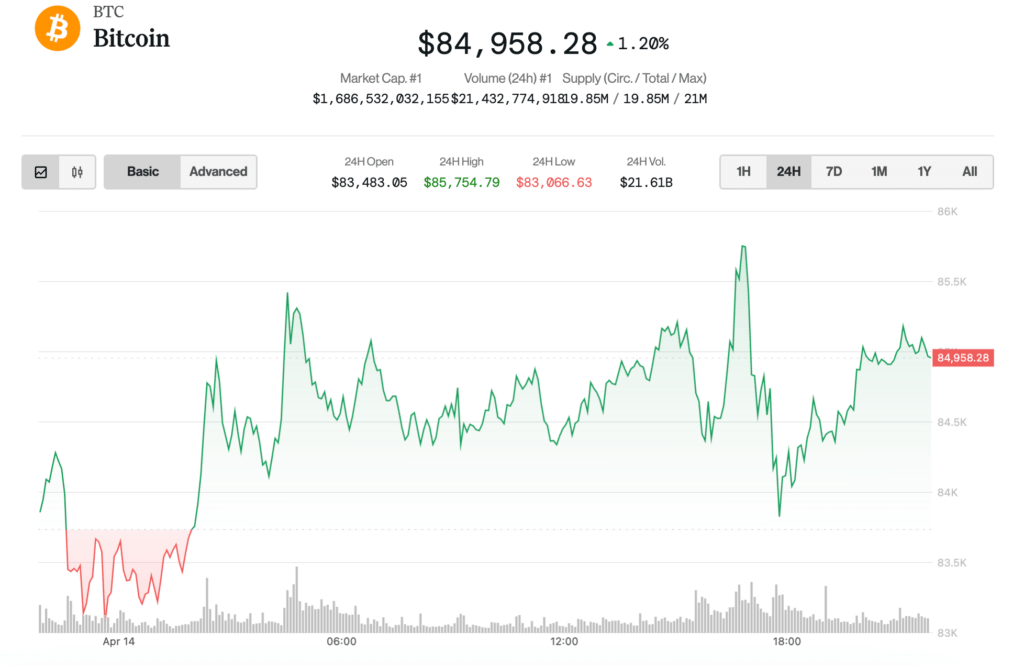

Bitcoin (BTC) moved very gently upwards on Monday, since the broader market fits favorably to the news related to trade.

The largest cryptocurrency increased 1.6% in the last 24 hours and now listed just $ 85,000. Ethher (ETH), meanwhile, increased 2.7% in the same period of time to $ 1,630. The large market PakGazette index, consisted of the 20 main cryptocurrencies for market capitalization, except the stable, memecutes and exchange currencies, advanced 1.2%, led by profits in Sol and Avax.

After a couple of wild weeks, the stock market also increased today, the Nasdaq closed with a gain of 0.6% and the S&P 500 increased 0.8%. Strategy (MSTR) and Mara Holdings (Mara), led between cryptography actions with profits of approximately 3%.

The modest concentration occurred when the governor of the Federal Reserve, Christopher Waller, said that a return of the original punitive tariffs of Trump would trigger the need for considerable cuts of “bad news” fees.

“[Tariff] The effects on production and employment could be more durable and an important factor in determining the adequate position of monetary policy, “Waller said in a speech.” If the deceleration is significant and even threatens a recession, then he would expect to favor the reduction of the FOMC policy rate before and, to a greater extent than he had thought earlier. “

The most rented concerns were the European Commission, the executive arm of the EU, confirming to stop the retaliation tariffs on the assets of the United States.

The probabilities that the United States and the EU reach a commercial agreement to avoid tariffs increased to 65% in the Polymercado of the Blockchain -based prediction market after the president of the United States, Donald Trump, declared that he was working on an agreement.

Bitcoin Funds recovering

The Bitcoin relief rally of the tariff agitation last week stopped around the resistance level of $ 85,000, but the network that improves the foundations of the network spur the hopes of a break, said the Swissblock Technologies cryptographic analysis firm.

“Since March, we have seen a constant entrance of new participants,” wrote Swissblock analysts in a telegram transmission. “Liquidity is stabilizing, no more erratic changes since the beginning of 2025”.

“Once the liquidity meter is maintained above line 50, the short -term price action tends to continue with strength,” said Swissblock analysts. “With the alignment of network growth, key levels are not only checked, they are accumulating.”

“This is the type of structural support that supports sustainable manifestations,” they concluded.