The mood in the capital and cryptographic market became sour on Wednesday night, since Nvidia’s actions crashed into the negotiation outside the schedule To prohibit The company’s H20 chips sales to China.

Bitcoin, the leading cryptocurrency by market value, fell to $ 83,600, extending the withdrawal from the maximum of two weeks of $ 86,440 reached earlier in the day, they showed the data of COINDESK. XRP centered on payments followed a similar trajectory, falling more than 2% to $ 2.08, while Cardano Ada fell 4% to $ 0.61. The Coendesk 20 index, a broader market meter, weakened more than 2%.

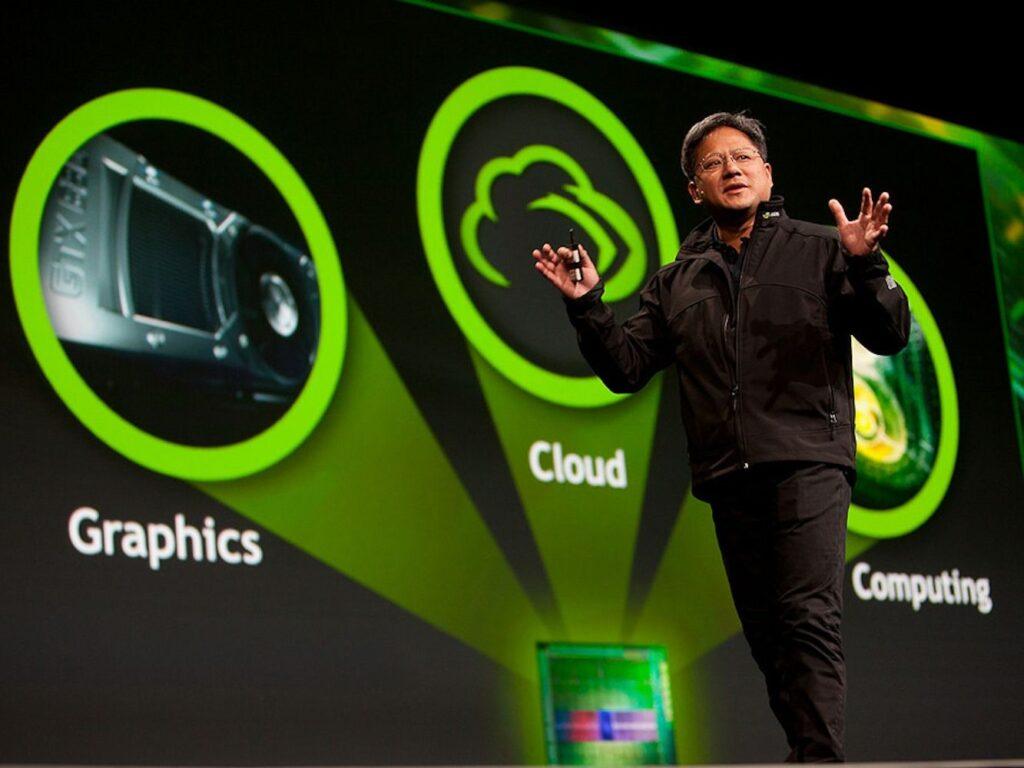

Meanwhile, the coins allegedly associated with artificial intelligence (AI) continued to get worse, since NVDA shares shuddered by 8% to $ 89.10 after the company revealed in a regulatory presentation that hopes to write $ 5.5 billion in the first fiscal quarter due to the new restrictions on the exports of its chip H20 to China.

The news occurred one day after an unusual activity in the NVDA sales options that pointed to an imminent fainting of the market.

Futures linked to Nasdaq index also fell more than 1%, offering negative signals to risk assets in general.

The next catalyst waiting for the launch on Wednesday morning, East time is the US retail sales report. For March. According to economists surveyed by Dow Jones, the data is expected to show a 1.2% increase in consumer spending in the month, compared to a 0.2% rise in February.

A better expected report will probably help calm the fears of recession caused by the commercial war of President Donald Trump with China and other commercial partners. However, there is a risk that markets discarding it as a backward aspect, without taking into account the greatest escalation in the commercial tensions observed this month.

The president of the Federal Reserve, Jerome Powell, is also scheduled to speak Wednesday at the Chicago Economic Club about his perspective for the US economy.

“All eyes are put in Powell. The markets are containing the breath for Powell on Wednesday. Between the commercial war and the growing recession talk, the merchants are attending any track of the Fed could be forced to cut before expected,” said Secure Digital Markets in Tuesday’s research note.

Market -based measures, such as inflation breakes, have fallen in the midst of commercial tensions, pointing out the uninflaring impact of Trump’s rates. That could provide the Fed a margin of maneuver to reduce rates.

Earlier this week, the governor of the Federal Reserve, Christopher Waller, said that the bank would be forced to quickly make a series of “bad news” rates cuts if the president of the United States reimputed the taxes presented on April 2. Trump announced radical tariffs in 180 nations on April 2, but quickly suspends the same for most nations, excluding China, for 90 days.

Read more: Bitcoin looms at $ 85k since Waller de Fed suggests tariffs of ‘bad news’ if tariffs resume