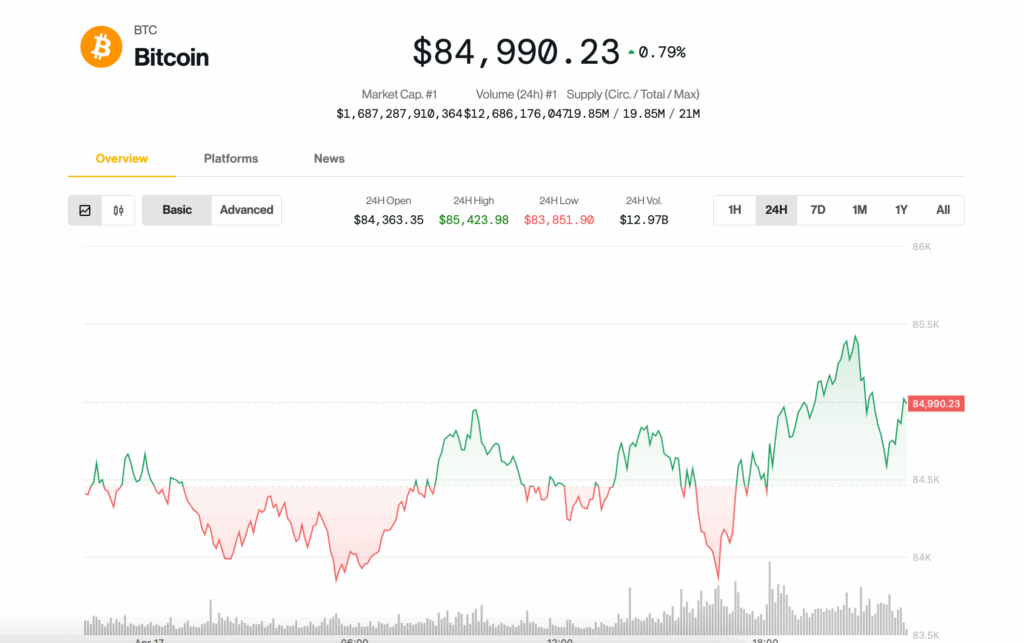

Bitcoin (BTC) was treading water just below $ 85,000 on Thursday night, since the tensions between the president of the United States, Donald Trump, and the president of the Federal Reserve, Jerome Powell, added another layer of uncertainty for investors.

The markets submerged on Wednesday after Powell’s aggressive comments, who criticized Trump’s tariff policy, saying that he would probably result in a slowdown economy and the increase in prices, what economists call “stagflation.” In his comments, Powell made clear his greatest approach for now he would be in prices, which suggests a stricter feeding policy than otherwise thought.

Trump, who nominated the former investment banker and lawyer as president of the Fed during his first term (Powell received a second four -year term by President Biden), has expressed his disgust with Powell since he resumed the White House. However, Powell, who is ready to remain at the top of the Central Bank until May 2026, has repeatedly declared his determination to finish his mandate and suggested that the president has no position to say goodbye.

On Thursday, the WSJ reported that Trump has been discussing Powell’s dismissal for months, according to people familiar with the matter. According to the reports, the former governor of the Fed, Kevin Warsh, is waiting on the wings as Powell’s replacement, but Warsh has pressed the president not to move against the president of the Fed, according to history.

Uniting Warsh in that warning is the secretary of the Treasury, Scott Besent, who said that the measure could move the US markets already trembling, since the central bank is supposed to be independent of political influences.

The probabilities that Trump eliminated Powell this year at the Polymarket of the prediction with blockchain headquarters increased to 19%, the highest reading since the launch of the end of January of the contract.

Trump’s comments reached the back of the European Central Bank (ECB) that reduced the key interest rates for the seventh consecutive occasion on Thursday, since it warned about a deteriorated growth perspective.

More pressure on the markets came from the last manufacturing index of the Fed of Philadelphia, published on Thursday morning, which showed bankruptcy activity this month, sinking at its lowest level (-26.4) in two years. Meanwhile, the paid price index rose to its highest reading since July 2022, which adds to the concerns about the large -scale tariff policy of the Trump administration, which pushes the United States economy to the stagflation.

The S&P 500 and the indices of heavy Nasdaq shares in technology were mainly plans during the day.

A look at the encryption market showed that BTC and Ethereum ETH rose 0.8% in the last 24 hours. The majority of the assets in the Coindesk 20 index were negotiated higher during the day, with Bitcoin in cash (BCH), near and leadership gains.

How the position of Bitcoin merchants in the midst of greater fear on Wall Street?

Bitcoin has stabilized between $ 83k and $ 86k with merchants chasing bullish bets while they still look for protection down.

In Delibit, merchants are actively chasing 90k calls to $ 100K. The call demand indicates expectations for a continuous price rally.

Some of these bullish bets have been financed by collected premiums selling sales options.

At the same time, interest has been renewed in buying $ 80k sales options that expire this month, which represents preparations for possible price decreases. Buying a sales option is similar to the purchase of insurance against price slides.

The diverse two -way flow occurs when the VX, the fear caliber of Wall Street that measures the implicit volatility of 30 days, still remains well above its average of 50 days, despite the setback of the maximums recent greater than 50.

The Vix warns that the macro situation is still falling apart instead of resolving, the exchange in X said.