Cryptographic -related actions increased on Tuesday, with the impulse of a broader cryptographic rally that has revived risk appetite in digital assets with Bitcoin (BTC) that crosses over $ 90,000.

Strategy (MSTR) shares, the largest head of Corporate BTC and Crypto Exchange Coinbase (COIN) increased from 8% to 9% during the session.

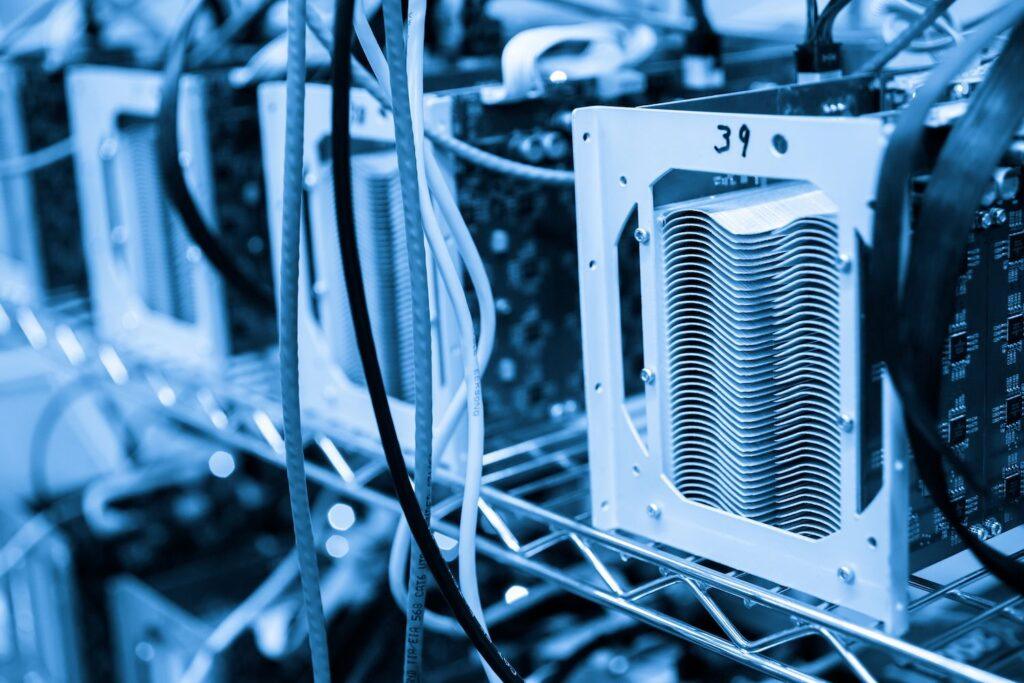

Leading the highest movement were Bitcoin miners, and many of them published two -digit profits, exceeding 5% BTC advance. Bitdeer Technologies (BTDR) recovered from 20%, while Bitfarms (Bitf), Cleanspark (CLSK), Cipher Mining (CIFF), Mara Holdings (Mara) and Riot Platforms (Riot) rose between 10% and 15% during the session.

Meanwhile, the broader stock market was also recovered from the decline of yesterday, with Nasdaq and S&P 500 2% and 1.7%, respectively. The demonstration in the tradfi market occurred when the reports of potential decallation of the US tariff tension raised the feeling of investors.

Risks of miners and rates

The rebound in mining actions occurs after months of low performance, heavy by compressed margins, increasing hashrate competition and tariff -induced difficulties, all of which are combined with a broader weakness of the market for risk assets. The majority, if not all, the miners who quote on the stock market are still quoted near minimum of several months.

In a matter of mining operations based in the United States. That means that mining operations in the US will probably grow at a much slower pace or even stop growing completely.

Tariffs “will materially affect future spending and capital in the United States,” said Taras Kulyk, co -founder and CEO of the Synteq digital mining hardware supplier.

“Other jurisdictions that had previously seemed a higher cost [will] become requested objectives for the new Infra and Capex implementation. Canada in particular, will probably be a benefactor for the implementation of the global tariff regime that the White House established instead. “

In relation to the superior performance of Bitdeer, one of the reasons behind Bitdeer’s higher performance may be due to the fact that the company is developing its own ASIC manufacturing business and recently made the decision to develop its self -mining capabilities instead of selling its platforms in a slower market. Stablecoin Giant Tether has also been in a purchase shopping shop in BTDR shares; Until last Thursday, the company had invested $ 32 million in Bitdeer.

Even so, most mining actions have been in the bearish trend since December, long before the White House announced its new tariff policy. Now, with BTC climbing above the key technical levels and the liquidity that return to space, the miners are probably catching an offer like a leverage proxy for the BTC rise.

Regardless of today’s higher performance, tariffs will continue to play a key role in miners and most of the actions related to cryptography, along with other risk assets. With the profit season starting soon, all eyes will be in the comments of the CEO on how the situation of the rate will change the corporate perspective. In particular, Elon Musk’s Tesla, which also has Bitcoin in his treasure, will report his profits after the market on Tuesday, which could provide an idea of how merchants must set the price in the uncertainties of the commercial war.