The Swiss National Bank has rejected the celebration of Bitcoin reserves, citing concerns about the liquidity and volatility of the cryptocurrency market.

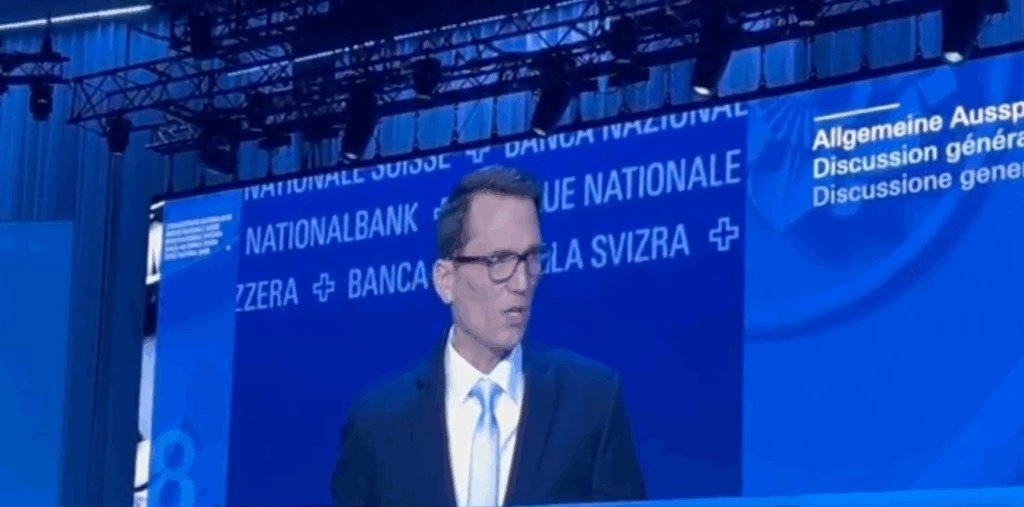

“For cryptocurrencies, market liquidity, even if it may seem good sometimes, it is especially during the naturally questioned crises,” said SNB president Martin Schlegel, at the meeting of the Bank’s General Assembly on Friday.

“Cryptocurrencies are also known for their high volatility, which is a risk of preservation of long -term value. In summary, it can be said that cryptocurrencies at the moment do not meet the high requirements for our foreign exchange reserves.”

Schlegel’s comments were promoted by the Bitcoin initiative, a Bitcoin defense group whose research shows that adding Bitcoin to Switzerland’s treasure would complement his general portfolio and produce substantial performance with a minimum volatility.

Without Bitcoin, the Swiss National Bank investments grew by approximately 10% since 2015. According to a simulation of the Bitcoin initiative initiative, an Initiative Bitcoin assignment of 1%. The annualized volatility would have increased only slightly.

The Bitcoin initiative emphasized that Bitcoin’s volatility should not be evaluated in isolation, but in terms of its influence on the general dynamics and the performance of the investment portfolio.

“[Bitcoin] The price reached new maximums, showed resistance under market stress, and remains highly liquid with commercial volumes in the billions of two digits, every day and night, even on holidays, “said Luzius Meisser, a member of the Bitcoin initiative and a member of the Bitcoin Suisse Board.

“The Bitcoin Network remains one of the most reliable and safe IT systems ever created. And more markedly, the United States has begun a strategic Bitcoin reserve.”

In a statement sent by email to Coindesk, the Bitcoin initiative suggested that the aversion of the National Swiss Bank to Bitcoin could be political, since it could be perceived as “an expression of distrust of other currencies” and damage the delicate relations between Switzerland and the European Union.

The president of the European Central Bank, Christine Lagarde, has constantly criticized Bitcoin, describing it as “is worth nothing” and a “highly speculative asset” linked to money laundering. In January, Lagarde said “I am sure” that “Bitcoins will not enter the reserves of any of the central banks of the General Council” of the ECB.

That was in response to the comments made by the governor of the Czech National Bank Ales Michl that his institution was evaluating Bitcoin to his reservations. Lagarde argued that Bitcoin does not comply with the ECB criteria for liquidity, security and security of criminal associations.

In February, the Central Bank of Poland ruled out “maintaining reservations in Bitcoins under any circumstance” and the Romanian Central Bank warned banks that they did not issue loans to cryptographic companies.

The president of the Federal Reserve, Jerome Powell, said in December 2024 that the US Central Bank. “He had no allowed to own Bitcoin” according to the Federal Reserve Law and that he does not seek to change the law.

The Swiss National Bank has exposure to Bitcoin through actions that have Bitcoin corporate bitcoins, including 520,000 strategy actions, 8.12 million actions of Tesla, 580,000 actions of Mara Holdings and 500,000 CleansPark actions, at the end of 2024 according to Fintel data.

Schlegel rejected citizens to add Bitcoin reservations to the coffers of the Swiss Central Bank as recently as last month. When it comes to technological advances, Schlegel pointed out on Thursday that the SNB is executing a pilot project using digital currencies from the Central Bank to facilitate payments between financial institutions.

On the contrary, the president of the United States, Donald Trump, signed an executive order this year that establishes a strategic Bitcoins reserve and a cryptographic reserve, together with a cryptographic council that will evaluate neutral budget forms to complement the digital reserves of the United States. The order prohibits even more government agencies from creating or promoting a digital currency of the Central Bank in the United States due to privacy problems for citizens.