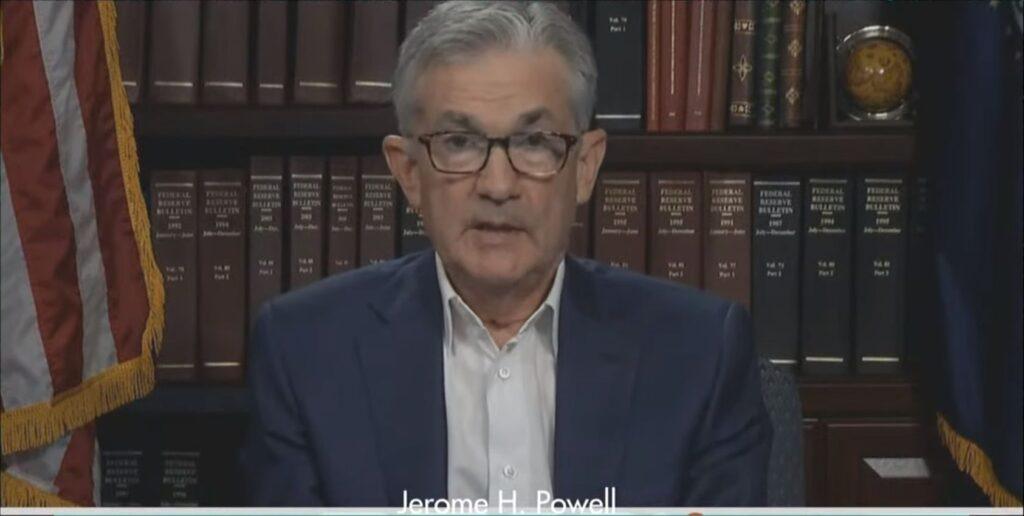

ADA and XRP of Cardano led the losses between the specialties on Tuesday when the merchants expect the result of the next meeting of the Federal Reserve (FOMC), where the rates are expected to remain unchanged, but the comments of the president of the Fed, Jerome Powell, could provide signals on a higher market positioning.

Bitcoin prices (BTC) remained above $ 94,000 after submerging briefly below that level on Sunday, continuing their recent scope behavior.

Ada’s price fell almost 4%, while XRP slipped similarly. Ethher (ETH) fell almost 1%, the BNB of the BNB chain increased 1.3% and Memecoin Dogecoin (Dux) dropped 2% in the last 24 hours.

The Coendesk 20 (CD20) of broad base, a liquid index that tracks the largest tokens due to market capitalization, fell a little more than 1.8%.

In other places, some tokens defi such as AAVE, CRV of Curve and the exaggeration of Hyperliquid have seen an increase in demand during last week in a sign of merchant interest towards projects with utility and performance mechanisms, some say.

“As Memecoins falls out of favor, merchants are resorting to projects with stronger foundations and tokens economy,” said Kay Lu, CEO of Hashkey Eco Labs, Coindesk in a Telegram message.

“Defi ecosystems are benefiting from this pivot, especially because Bitcoin shows a decrease in volatility and macro uncertainty.

Hype led profits among the 100 main tokens with a 72% increase in the last week, with AAVE and CRV up to 40%.

Powell comment on focus

Merchants in the financial markets of Crypto and Cryptocurrencies are considering the decision of this week’s FOMC interest rate, with consensus expectations that point to a pause in rates increases.

However, uncertainty about inflation, tariffs and broader commercial tensions of the United States and China have left many cautious participants.

“We do not expect FOMC to activate an important movement in the markets,” said Augustine Fan, chief of insights in Signalplus, in a telegram message. “It is a currency. The crypt will probably make signals of the broadest growth of profits and how the economy digests the impact of recent commercial policies.”

The recent strength of the stock market suggests that investors have pricing at just a risk of mild recession, around 8%, according to historical reduction models. That contrasts with more bearish signs from bond markets and macroeconomic forecasts, Fan added.

Last week, President Trump did not confirm immediate plans for conversations with China, cushioning the hopes of an advance in commercial and Chinese commercial negotiations. Even so, the possibility of separate trade agreements has helped keep intact the feeling of risk, as reported on Monday.