Bitcoin (BTC) tightened Tuesday in the cryptographic market, and the domain increased to a new four years as cryptography merchants revolved in the market anchor asset before the Key Federal Reserve Policy meeting of the market.

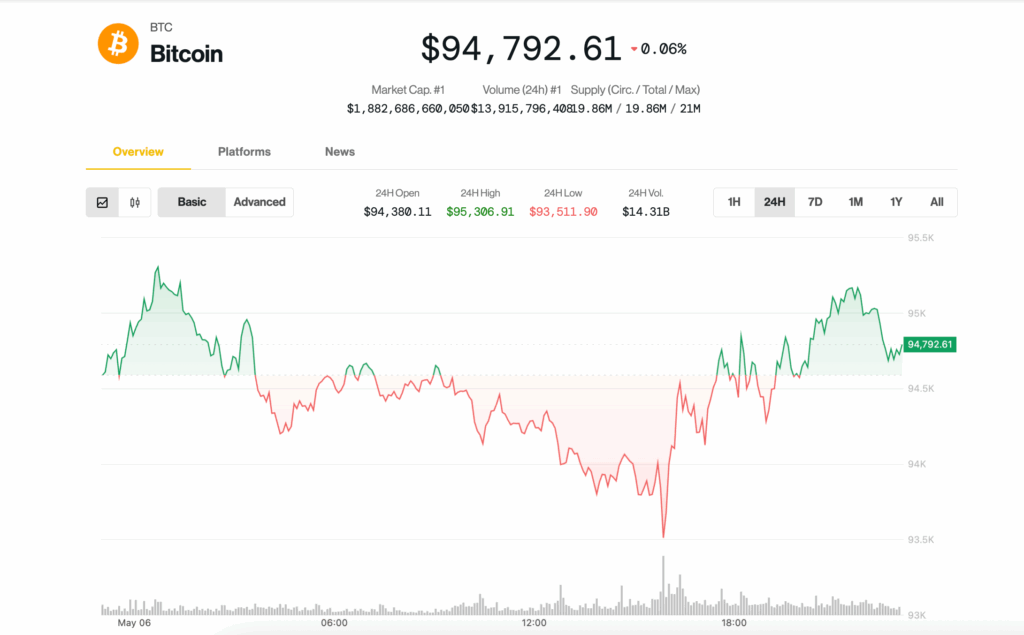

BTC remained stable around the $ 94,000- $ 95,000 area, a modest 0.4% in the last 24 hours and extending a close range negotiation pattern that has persisted since the weekend.

Meanwhile, the large market index of the large market fell 0.7% lower, with Ethereum’s Ether (ETH), and Sui Native Tokens (SUI), Aptos (APT) and Polygon (POL) dragging the lowest reference point.

A check in traditional markets showed that the actions reserved consecutive losses, with the S&P 500 and the nasdaq heavy technological closing 0.7% -0.8% inactivated, once again with a lower performance of BTC.

Despite the lack of a great price action, Focus has increasingly resorted to Bitcoin’s growing participation in the general cryptographic market: the Bitcoin domain metric call exceeded 65%, its highest reading since January 2021, according to commercial data, which indicates that capital is consolidated in the asset is perceived as the most resilient in the face of the macroeconomic certificate.

Joel Kruger, LMAX Group market strategist, described the current panorama as one of pause and anticipation. “The cryptocurrency market has been largely stagnated from the weekly open, with the prices of a tenure pattern as investors expect a fundamental catalyst,” he said. “This impetus can arise from traditional markets, driven by updates on economic impacts related to the rate or the anticipated decision of FOMC of the Federal Reserve on May 7.”

It is widely expected that the Federal Reserve maintain stable interest rates, according to the CME Fedwatch tool, but merchants are ready for any change in the tone of the Fed president, Jerome Powell, which could affect the appetite of risk.

Bitcoin’s volatility exploded on the horizon

Since Bitcoin’s recent price action is extremely flat, the next FOMC meeting “is managed to cause significant volatility,” said Vetle Lunde, head of K33 research. He pointed out in a Tuesday report that the short -term volatility of BTC is “abnormally compressed”, with the average drop of 7 days to the level of last week in 563 days.

“Such regimes of low volatility in BTC tend to be short duration,” Lunde said. “Violent volatility outbreaks generally follow this form of stability once prices begin to move, since leverage transactions are grown and merchants are reactivated in the market.”

He said that a lower significant waterfall is unlikely, since financing rates for perpetual swaps are consistently negative. Similar periods historically offered good purchase opportunities for medium and long term investors, Lunde added, favoring “exposure to aggressive points” ahead.