Global economic uncertainties are remodeling cryptocurrency markets, since BNB demonstrates an exceptional strength in augmented commercial tensions. Token’s impressive performance occurs when institutional investors seem to be accumulated positions, evidenced by the volume of negotiation that almost double at $ 1.08 billion.

Meanwhile, the BNB chain ecosystem continues to expand its usefulness through the integration of AI and reduced gas rates, positioning it favorably against competitors such as Solana and Ethereum.

TECHNICAL ANALYSIS

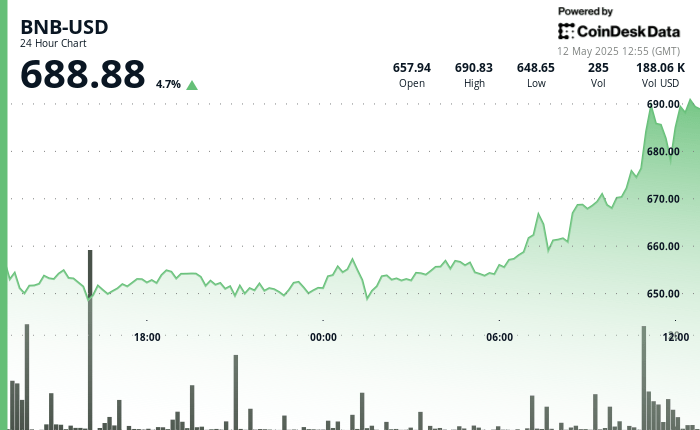

- BNB formed a clear ascending channel with a strong volume support at the level of $ 657- $ 658, where the purchase pressure accelerated dramatically, according to the technical analysis data model of Coindesk Research.

- The volume increased to 151,956 BNB during the 07:00 hours, almost 4 times the average of 24 hours, indicating a significant accumulation.

- Three consecutive hours of high volume between 07: 00-11: 00 culminated in the strongest volume of 251,202 BNB during the last hour.

- A head and shoulder pattern formed at the final time with the right shoulder by completing about 11: 34-11: 36, before breaking the neckline support at $ 684.

- The large commercial volume during 11:04, 11:15 and 11:21 periods suggests an institutional positioning before reversal.

- The closing price of $ 678.07 represents a 1.7% decrease from the maximum of the hour, with a growing sales pressure in the last 10 minutes as prices tested the support level of $ 677.

Discharge of responsibility: This article was generated with artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy. This article may include information from external sources, which are listed below when appropriate.

External references