0X, a decentralized exchange infrastructure firm announced the acquisition of rival Flood, a measure that the company says it will help it compete in the hyper competitive aggregation market.

Decentralized exchanges, or dexs, are an cornerstone of the defi ecosystem. They let blockchain users exchange between assets without the need for an intermediary or intermediary, such as a centralized exchange.

The aggregators such as 0x act as a unique window for merchants, looking for all the DEX to find the one that offers the most profitable operations, for a small rate. The competition is fierce already exists on thin margins.

It was Flood’s patented aggregation software that motivated the acquisition, said Amir Bandeali, CEO of 0x, Coendesk in an exclusive interview.

0X uses your own trade simulation technology to verify how well your aggregation software works compared to its competitors, Bandeali said. “We were able to take a look at the flood and execute similar types of tests and we were very impressed with the data we saw.”

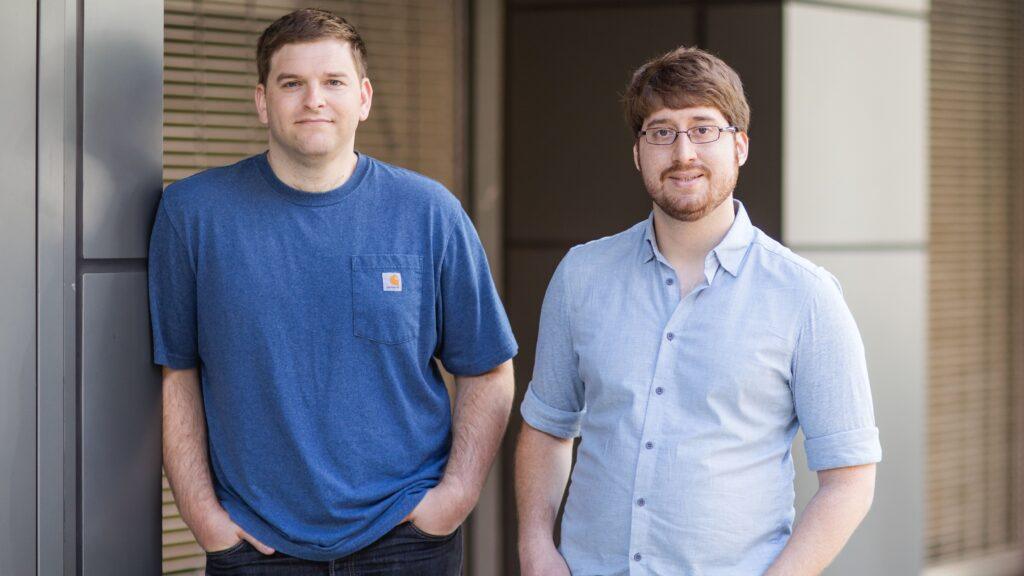

“Everything was done from scratch,” Francesk Baccetti, co -founder and CEO of Flood, told COINDESK. “We rewrite the entire battery to obtain this level of performance that we now have.”

The acquisition is the first of 0x from the foundation of the company in 2017. A 0X spokesman declined how much he paid for the flood, citing contractual obligations. Flood raised $ 5.2 million of investors in a financing round of February 2024.

Dex aggregators are a big business. During the last week, the 12 main aggregators facilitated almost $ 10 billion in volume of exchange, about 10% of all operations in the chain, according to the data compiled by Fredrik do, co -founder of Dune Analytics.

Aggregate with negotiable tokens are valued at $ 2.3 billion combined, according to Coingcko data.

0x is one of the oldest aggregators. But it is not the biggest.

In Ethereum and other compatible blockchains, 1 inch and cows exchange constantly handle the most commercial volume between aggregators, while in Solana, Jupiter dominates.

Bandeali said he has the hope that when combining the technologies of the two companies, 0x can gain market share of larger aggregators in Ethereum and Solana.

‘Niche domain’

Another motivation for acquisition was the Flood developer team.

“This is a quite a mastery of niche,” said Bandeali, explaining that it is very difficult for his company to find talented developers that specialize in commercial aggregation and routing.

Therefore, having adequate developers is crucial for the continuous success of an aggregator.

“Sounds simple but it’s really complicated,” he said. “It becomes more complicated as new chains and new tokens are thrown.”

The reward for demonstrating the best exchanges is excellent. Cow Swap is ready to generate almost $ 11 million in revenue this year, according to Defillama data. (It is not clear how many income generates 1 inch, while the projected income of $ 162 million Jupiter comes from more than only their aggregation services).

0x has also expanded to other areas, such as providing API that integrates its aggregator into other products and trade analysis.

But improving its central aggregation product, which drives exchanges in applications such as Coinbase Wallet, Robinhood, Phantom and Farcuter, remains the main approach.

And with more complex defi, it is likely that the demand for aggregators will continue to increase.

“We are only trying to abstract complexity faster than is created for our clients,” said Bandeali.

Read more: Dex aggregator 1 inch integrates Zksync to increase cross chain swaps