The cryptocurrencies recovered the base on Monday after a difficult start to the negotiation session, reflecting a broader recovery in risk assets as merchants digested Moody’s reduction of the United States government bonds.

Bitcoin

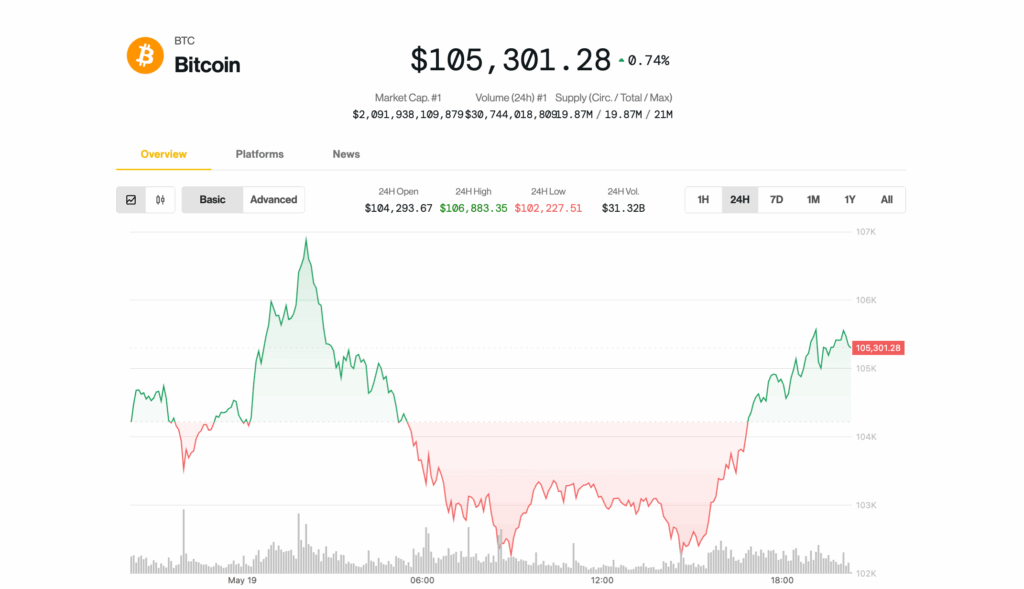

He scored a strong rebound after falling up to $ 102,000 at the beginning of the US session, after its record closure at $ 106,600 during the night. The largest cryptocurrency for market capitalization returned to $ 105,000 in the afternoon negotiation, 0.4% more in 24 hours. Ether increased 1.2%, recovering the level of $ 2,500.

Defi Aave loan platform

Its surpassed to most of the high capitalization altcoins, while most members of the Broad Market Coindesk 20 index still remained in red despite advancing from their daily minimums. Solana, Avalanche and Polkadot fell 2%-3%.

The rebound extended to the actions of the United States as well, with the S&P 500 and Nasdaq erasing its morning decline.

The early recoil in crypto and stocks occurred after Moody’s Friday reduced the credit rating of the United States of its AAA state. The movement shook bond markets, which pushes 30 years of treasure performance above 5% and the 10 -year note to more than 4.5%.

Even so, some analysts minimized the long -term impact of the reduction on assets prices.

“What are you doing [the downgrade] Medium for markets? In the longest, really nothing, “said Ram Ahluwalia, CEO of the Lumida Wealth Heritage Management firm.

“Moody’s is the last of the three main qualification agencies to degrade US debt. This was the opposite of a surprise: it was a long time that came,” said Callie Cox, the main strategist of the Ritholtz Wealth Management market, in an X position. “That is why shares of shares do not seem to care.”

Bitcoin is aimed at $ 138K this year

While BTC floats just below its January record prices, the ETF issuer of 21Shares digital assets sees more rise for this year.

“Bitcoin is on the edge of a break,” wrote the Matt Mena research strategist in a Monday report. He argued that the current BTC rally is not driven by retail mania, but by a confluence of structural forces, including institutional entries, a crunch of historical supply and an improvement of the macro conditions that suggests a more lasting and mature path towards the maximum new of all time.

The ETF Spot Bitcoin have constantly absorbed more BTC than is extracted daily, hardening the supply, while the main institutions, corporations such as the strategy and the newcomer twenty -one capital accumulations and even the states explore the creation of strategic reserves.

These combined factors could raise BTC to $ 138,500 this year, Mena was forecast, translating to a rally of approximately 35% for the largest cryptography.