The point on the American list Bitcoin

The funds quoted in the stock market (ETF) registered $ 667.4 million in net tickets on May 19, the total of a single larger day since May 2, indicating a renewed institutional interest.

Almost half of these tickets, $ 306 million, entered Ishares Bitcoin Trust (Ibit), now at $ 45.9 billion in net tickets, according to the investors of the data source.

The renewed demand follows the strong performance of Bitcoin prices, since it was negotiated above $ 100,000 for 11 consecutive days, which has helped restore market confidence.

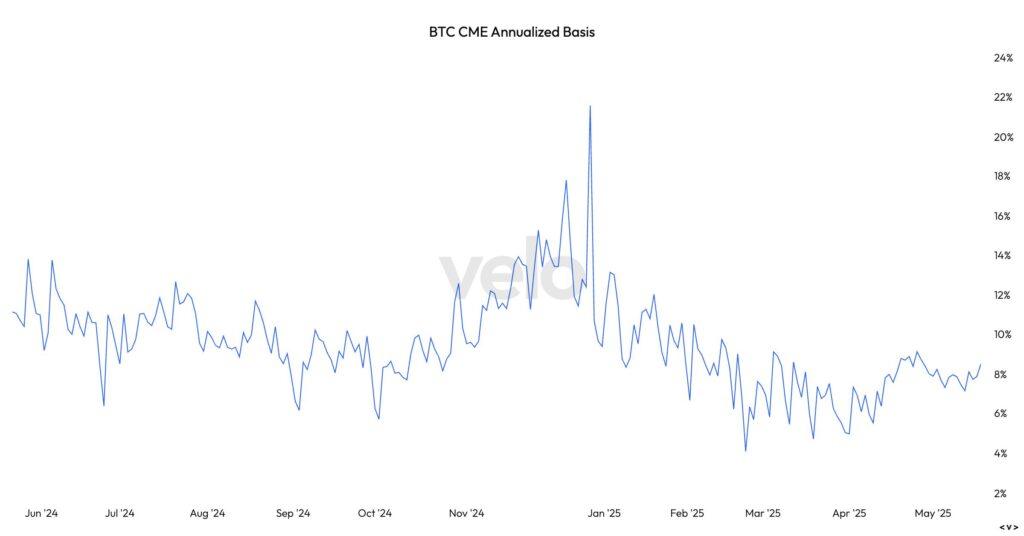

In addition, the annualized base trade, a strategy in which investors take a long time in the ETF spot and, at the same time, Bitcoin’s futures contracts in the CME have become increasingly attractive, and the yields are approaching 9% almost twice as long as it was seen in April.

According to veil data, this has caused a modest increase in basic commercial activity as evidenced by commercial activity in CME futures.

On Monday, CME futures volumes reached $ 8.4 billion (approximately 80,000 BTC), the highest since April 23. Meanwhile, the open interest was 158,000 BTC, more than 30,000 BTC contracts of the minimum of April, further underlining the growing appetite for lever and arbitration strategies.

That said, both the volume of futures and the open interest remain well below the levels seen during the Bitcoin historical maximum of $ 109,000 in January, which indicates that there is still a space for greater growth.

The increase in the base suggests that growth can already be happening, bringing back the players who left the market earlier this year when the base fell to less than 5%.

The recent 13F presentations revealed that the Wisconsin state pension board left its ETF position in the first quarter, probably in response to a favorable base environment. However, since data 13F are delayed in a quarter and the spread of the base has been extended from 5% to almost 10%, it is plausible that they have re -entered the market in the second quarter to capitalize on the improved arbitration opportunity.