Bitcoin

He scored a new historical maximum of $ 109,000 on Wednesday, but that is a small consolation for Bitcoin miners, who last month were forced to collect a record number of their BTC reserves, according to the media of News Mining Theminermag.

The firm’s latest research report reveals that public miners sold 115% of their Bitcoin production in April, which means they sold more than they produced. That is the highest relationship since the end of the Bear 2022 market.

Even today, with Bitcoin breaking a new record of more than $ 109,000, hashprice (what the miners gain per unit of computational power) has failed to do the same. It is located in just $ 55 by Petahash per second (pH/s), well below the level of $ 63/pH/s, briefly reached the last time Bitcoin crossed $ 100,000 in December. The high difficulty of the network and weak transaction rates have maintained income under pressure.

The best players in the mining space are expanding independently. CleansPark’s hashrate (CLSK) exceeded 40 EH/s, and Iren (Iren), which recently exceeded Riot (Riot) platforms as the third largest public mining in terms of hashrate performed, recorded a 25% jump in the power of the hash and now points to a total of 50 hu/s for June. Meanwhile, Cango (Cang) is looking at another 18 eh/s for July.

The hashrate installed by Mara Holdings (Mara) remains the highest with 57.3 eh/s, according to a Tuesday report from the Jefferies investment bank. Iren had the highest activity implicit in around 97%, followed by Hive Digital Technologies (Hive) to approximately 96%, the report added.

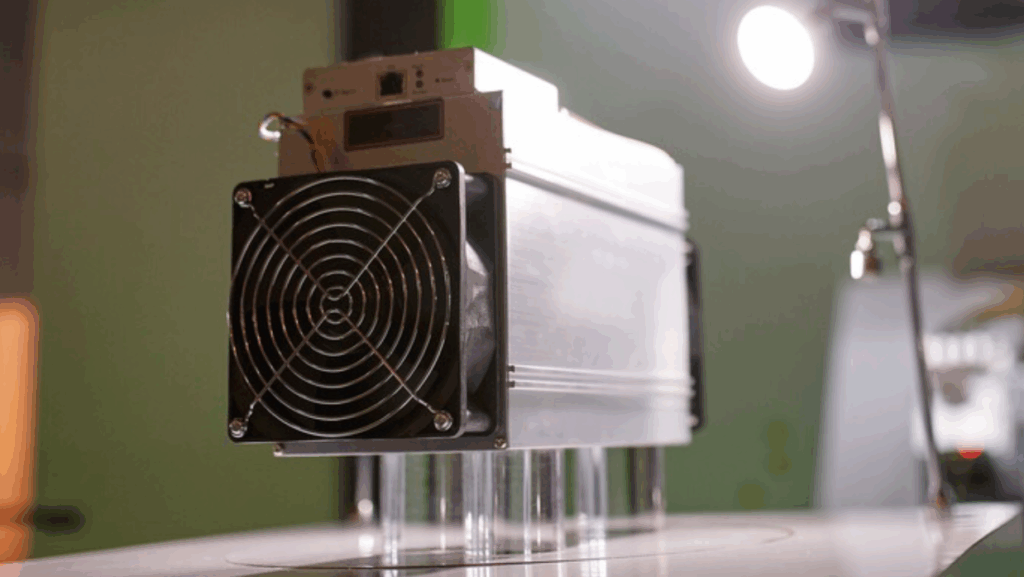

Meanwhile, there is a change in how miners are ensuring a new hardware. Several public companies have signed agreements with Bitmain that allow them to pay mining platforms in Bitcoin while retaining the right to repair their coins at a predetermined price, coverage against greater price demonstrations.

Mining actions, mistreated in the first quarter, have recovered, some in more than 60% only in April, although most remain so far this year. Only Cleanspark and Mara Holdings are in positive territory for the year.