The cryptocurrency market continues to feel the effects of global economic tensions, with the feeling of investors that balance under the weight of the increase in geopolitical risks and commercial uncertainty.

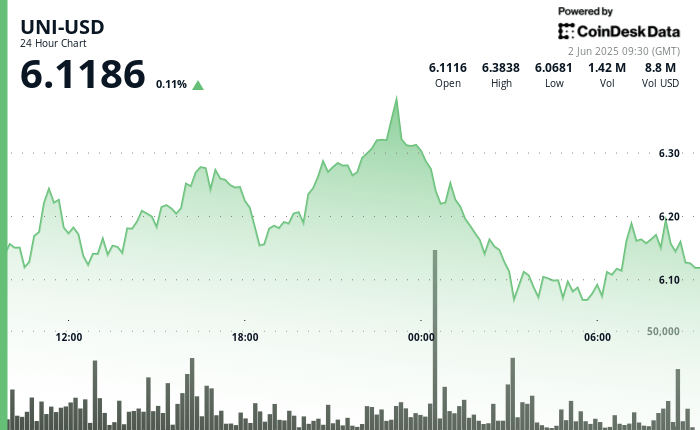

Uniswap Uni Token saw a strong intradicate blow between $ 6,045 and $ 6,385 before stabilizing above $ 6.11, pointing out the precautionary support of the buyer, according to the Coindensk Research technical analysis data model.

Although the UNI was briefly recovered after the first losses, analysts warn that winds against macroeconomic, including rates scales and late monetary flexibility, can limit short -term profits even as key technical levels remain for now.

TECHNICAL ANALYSIS

- UNI experienced significant volatility for 24 hours, with prices of reach of $ 6,385 before deciding to a minimum of $ 6,045, which represents a range of 5.33%.

- A remarkable resistance zone was formed around $ 6.30–6.38, with an emerging high volume sale at these levels, particularly during 23:00 hours.

- The support was established in the range of $ 6.05–6.08, where buyers intervened during the early hours of June 2.

- A decrease in the volume profile and the lack of recovery of previous maximums suggest that the bearish impulse can continue in the short term.

- In the last hour of the analysis window, the UNI showed a recovery pattern, rising from $ 6,146 to $ 6,176 for a gain of 0.48%.

- The strong support remained at $ 6,148–6,152 during a brief sale of the sale at 07:35, reinforcing that area as a short -term key floor.

- The volume analysis shows a renewed purchase interest during the sail of 08:00, where the price increased to $ 6,176 by volume higher than the average.

- Uni is currently around the $ 6.12– $ 6,18 resistance band; A clear rupture above this level remains key to confirm any possible bullish investment.