Bitcoin

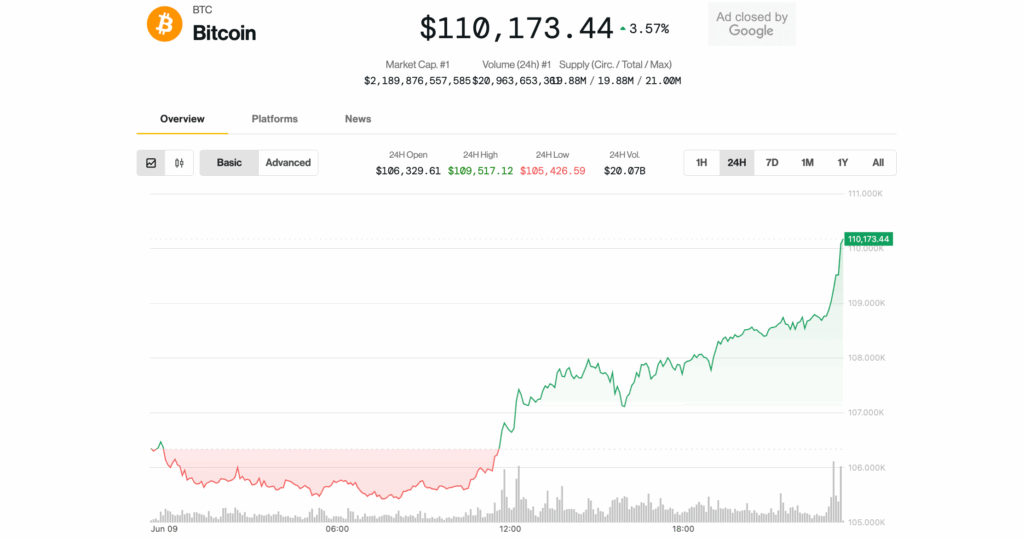

The quiet increase on Monday accelerated at its strongest price in June, bouncing from the decline last week to the highest levels of all time.

The largest cryptography advanced by 3.7% in the last 24 hours, exceeding $ 110,000, and is changing hands in just 2% of its record prices observed in May. Ethereum’s Ether

He kept the pace of a gain of 3.8% during the same period, bouncing above $ 2,620. Native hyperlichid tokens and Sui beat most of the cryptocurrencies of great capitalization, increasing 7% and 4.5%, respectively.

The highest Bitcoin movement caught the leverage operators outside the guard outside the guard, liquidating more than $ 110 million in short positions in an hour, as shown in the caramel data. In all cryptographic assets, about $ 330 million shorts were settled during the day, the largest amount in a month. Shirts seek to benefit from the decrease in assets prices.

The measure occurred, while traditional markets showed a silenced action, with the S&P 500 and Nasdaq rates in the day. Cryptographic -related actions bounced during the session to catch up with the recovery of BTC over the weekend.

“A ‘Pacific Rally’ is a perfect way to describe this price action,” said the well -followed analyst Caleb Franzen, founder of Cubic Analytics. “Only a constant development of higher and higher high ups and downs. Any sign of weakness? Buyers intervene and defend the trend.”

The encryption market is now standing more stable for a possible higher potential stage after the 10% decrease in Bitcoin to about $ 100,000 and with more than $ 1.9 billion in liquidations among cryptographic derivatives during the past week, having rinsed excessive influence, Bitfinex analysts observed in a Monday report.

However, the data in the chain indicate the growing sale pressure of the long -term holders who could overwhelm the demand, the analysts added.

“Bitcoin is now at a crossroads, balanced between the structural support and the diminishing bullish impulse, waiting for his next macro sign,” Bitfinex Note added.

These macro catalysts can arrive at the end of this week, said Jake or, OTC merchant of the Wintermute cryptographic trade firm.

“The commercial representatives of the United States and China are scheduled to meet today, with markets probably sensitive to the owners after the positive impulse last week, and the data calendar remains light until Wednesday, when the CPI will offer a new vision of the inflation of the United States,” he said.

Update (June 9, 21:51 UTC): Add short liquidation data.