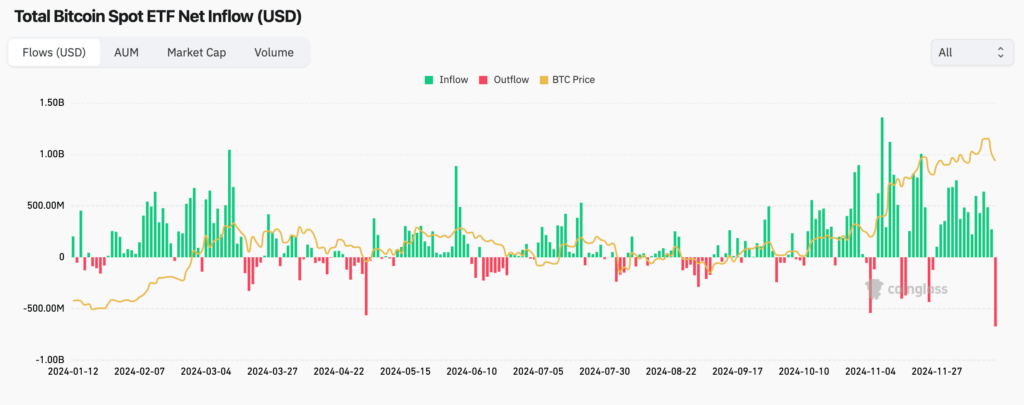

US-listed bitcoin (BTC) exchange-traded funds (ETFs) saw record outflows on Thursday and the CME futures premium fell to single digits in a sign of weakening near-term demand.

Investors ended a 15-day inflow streak by withdrawing a net $671.9 million from the 11 ETFs, the most in a single day since their inception on Jan. 11, according to data from Coinglass and Farside Investors.

Fidelity’s FBTC and Grayscale’s GBTC led the outflows, losing $208.5 million and $188.6 million, respectively. Other funds also recorded outflows and BlackRock’s IBIT recorded its first zero in several weeks.

Bitcoin extended its post-Fed losses on Thursday, falling to $96,000, down nearly 10% from the all-time high of $108,268 seen earlier this week.

The bearish sentiment was reflected in the derivatives market, where the annualized premium in CME-regulated one-month bitcoin futures fell to 9.83%, the lowest level in more than a month, according to data source Amberdata .

A decline in the premium means that cash-and-carry arbitrage bets involving a long position in the ETF and a short position in CME futures yield less than before. As such, ETFs may continue to see weak demand in the near term.

Ether ETFs also recorded a net outflow of $60.5 million. It is the first time since November 21. Ether has fallen 20% from levels above $4,100 ahead of Wednesday’s Federal Reserve decision.