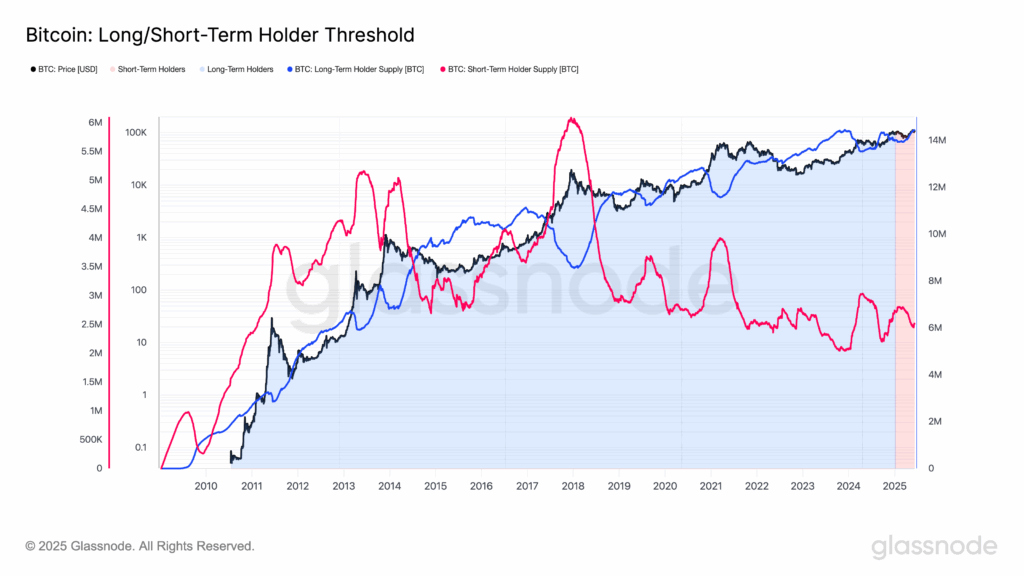

The long -term bitcoin supply (LTH), as traced by Glassnode, has increased to a record of 14.46 million BTC, indicating the confidence that the price earnings are in the store.

Lths, defined as investors that have Bitcoin

For at least 155 days, they are often considered “intelligent money”, strategically buying during price casualties and sale during the peaks of the upward market. This maximum of all time in Lth Supply suggests that experienced investors anticipate higher prices, a pattern historically associated with important price manifestations.

From March to June, the supply of LTH increased by approximately 500,000 BTC, while short -term headlines (STHS) sold around 350,000 BTC

Many investors were now classified when LTH entered the market in the middle of the euphoria of the opening of Trump of January and the record of $ 109,000. Five months later, after having suffered a correction of 30% and now the return to a record, these LTH are demonstrating resilience.

LTH currently represent approximately 73% of Bitcoin’s circulating supply of 19.88 million BTC, which underlines their market domain. This Bitcoin concentration in the long -term hands suggest potential for a higher price.