The Shiba Inu (Shib) whales seem to be at a mode of risk ahead of the fundamental inflation data of the United States, which will probably show a renewed increase due to the tariffs of the president of the United States, Donald Trump.

The main transactions of whales that exceed the $ 100,000 have crashed at 91.5% in the last four days, changing the control of the institutional investors market to retailers, according to the Insights of AI of Coindesk.

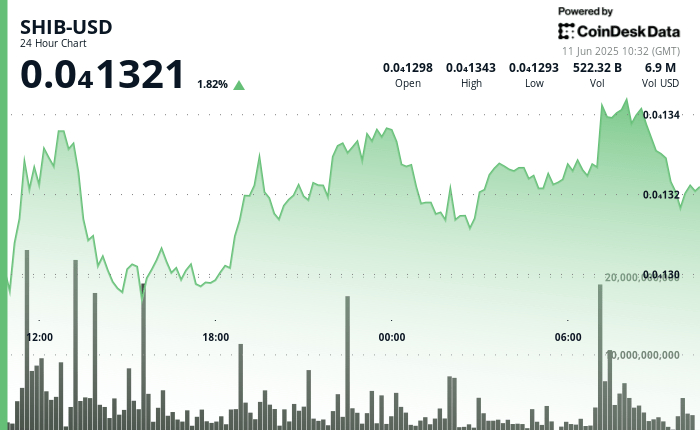

Prices, however, have increased the hopes of the Bulls, exceeding the key resistance to 0.0000133 with a mass increase of 975 billion volume. The cryptocurrency has also moved above the single mobile average (SMA) of 100 days widely seen.

In addition, a record of 1.5 million wallets now contains Tokens Shib, which represent 0.011% of the global population, an accelerated growth sign of the community.

Key technical ideas

- The Shib-USA pair rose from 0.0000129 to 0.0000134, which represents a 4.6% gain with a total range of 0.00000063 (4.9%).

- A significant increase in 975 billion at the final time promoted prices to exceed the level of resistance 0.0000133.

- The price action formed an ascending channel with higher at 0.0000129, 0.0000131 and 0.0000132.

- The level 0.0000135 now arises as the next key resistance objective for bulls to overcome.

- There was a strong upward break between 07: 11-07: 16, where the price increased from 0.0000133 to 0.0000135, which represents a gain of 1.5%.

- After reaching the high session, the price established a new support zone around 0.0000134, with multiple tests that confirm this level.

Focus on US inflation

According to FACTSET, the average estimate year after year for the consumer price index for May is 2.5%, an increase in the 2.3% increase in April.

If the data coincides, it will be the first increase in the number compared to the previous month since January 2025, validating the Federal Reserve Data position.

That said, the rebound in inflation led by the rate has been discussed in the markets for some time, and confirmation may not be a shock for the market. In other words, falls could be short.