Ether (eth)

He directed around $ 2,770 for most of Tuesday until approximately 8 PM ET, when the authorities said the negotiators in London had forged a draft of the US commercial framework -china. The scheme, until the presidential approval awaits, would see Beijing resume the rare land exports, while Washington facilitates advanced technology sales.

At 8:04 AM et on Wednesday, the former president of the United States, Donald Trump, published in Truth Social that “our agreement with China is made”, waiting for its formal approval of President XI. Trump said the agreement would leave US tariffs on Chinese imports effectively to 55 percent compared to 10 percent of Beijing, promised that China would carry front supplies of magnets and other rare earth materials, and said that Washington would defend concessions such as continuous access for Chinese students to US universities, describing the bilateral relationship as “excellent”.

The hopes of a thaw in the several -year rates dispute caused an initial risk offer: the global capital futures were commissioned, Bitcoin marked higher and Ether pushed approximately $ 2,780 expanding the spot billing.

The risk appetite intensified eleven hours later, around 8:30 am on Wednesday, after the United States Department of Labor reported that head header and CPI increased only 0.1 percent month to month, reducing forecasts of 0.2 percent of economists. The coldest impression promoted the expectations that the Federal Reserve could cut rates at the end of this year, which promotes the yields of the treasure and the lowest dollar while extending the profits in shares.

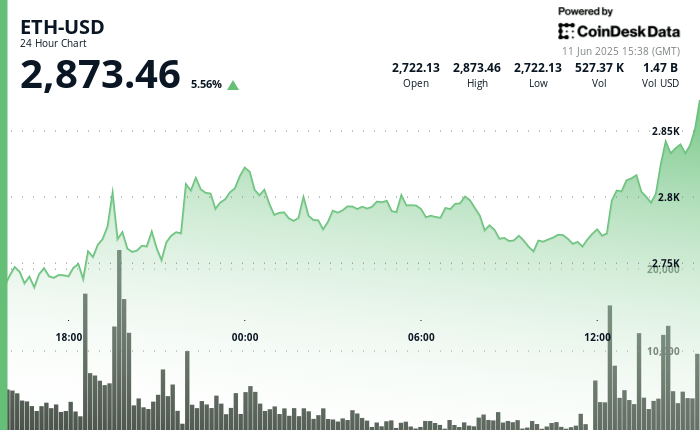

In that macro context, the ether jumped from the upper part of $ 2,780 to an intradic maximum of $ 2,873.46, with a swelling of punctual volume to approximately 527,000 currencies (~ $ 1.47 billion), according to the technical analysis model of Coindesk Research.

Structural tail winds remain strong. ETH staked rose to a record of 34.65 million tokens (≈28.7 percent of the offer), the funds quoted in the stock market registered a 16 -day entrance streak of about $ 900 million, and the futures open for the interest printed a new high above $ 21.7 billion, all underlining the constant institutional participation. Blackrock reported an accumulation of $ 500 million in the last ten days exemplifies that issue.

Merchants now look for a decisive closure above $ 2,900 to open a potential career in the $ 3,000 psychological brand, while protecting against a setback towards the newly established support band of $ 2,750– $ 2,760.

TECHNICAL ANALYSIS

- Trend: The highest minimum series since June 9 and a new high at $ 2,873 confirm an accelerated upward channel.

- Volume confirmation: The candle triggered by IPC printed the largest bar of the day (≈527 k eth), validating the rupture of Tuesday above $ 2,800.

- Support / resistance: The immediate support is at $ 2,750– $ 2,760; The upward objectives are $ 2,900 and the $ 3,000 psychological zone, followed by a secondary obstacle about $ 3,120.

- Impulse: The RSI per hour is maintained above 60, which indicates the room to extend before overcompra conditions arise.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.