Sui

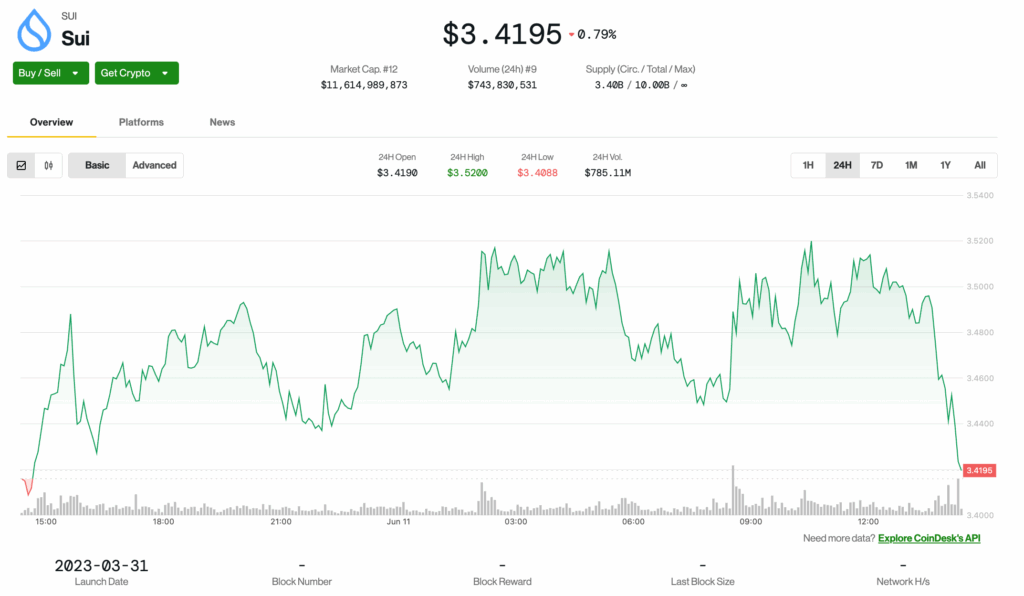

The native token of the sui block chain, increased slightly in the last 24 hours before falling sharply after macroeconomic factors reached global markets during the afternoon hours of the USA.

The Token increased after the news that Nasdaq presented a 19B-4 form before the United States Stock Exchange and Securities Commission (SEC) to list the 21Shares Sui Condex Fund. This marks the second main step in the ETF approval process. The first, a draft of a registration statement S-1, was presented by 21Shares in April.

If approved, this would be the first sui ETF spot that appears in the United States, offering traditional regulated access to the native token of the sui block chain.

Sui seemed to respond to development, showing strength during the night as it advanced at a resistance level at $ 3.49 with the support of a significant commercial volume, according to the technical analysis model of Cindensk Research. More than 13 million tokens changed hands during the rupture, which coincided with the presentation of Nasdaq.

During the afternoon of the United States, Sui fell sharply and has dropped approximately 1% at the time of publication. The Coendesk 20, which tracks the broader cryptographic market, only increased a little after receiving a success in the afternoon.

TECHNICAL ANALYSIS

- Sui experienced a decisive breakdown overnight above the resistance level of $ 3.49 with a volume greater than 13 million, significantly above the 24 -hour average of 8.7 million.

- Despite the minor setbacks, the Token found a constant support of around $ 3.45- $ 3.46.

- A high volume wave reinforced the bullish feeling, which suggests a continuous potential of the ascending impulse.

- The level of $ 3.50 has been established as a potential key resistance zone after temporary exhaustion of bullish impulse.

- The price of the action formed a potential base in the range of $ 3.48- $ 3.48 with a moderate volume support consolidation.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.