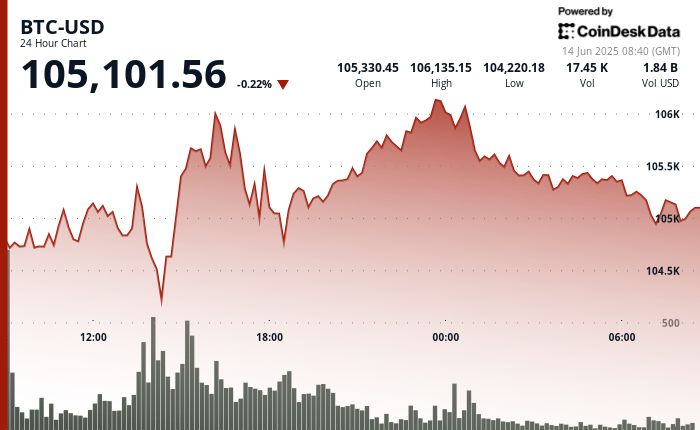

Bitcoin was around $ 105,100 on June 14, 0.22% less in the last 24 hours as merchants digested geopolitical tension. The price action remained relatively adjusted, with BTC moving within a range of $ 2,090 of $ 104,220 to $ 106,135. The largest movements occurred during the night in Asia’s trade, where Bitcoin briefly fell below $ 104,200 before recovering at high volume.

Much of the recent volatility has been driven by developments in the Middle East. The Israel-Iran War, which some analysts fear could extend to other parts of the Middle East, combined with commercial tensions between the United States and some of its key commercial partners, have unstable risk markets. More than $ 1.1 billion were recorded in cryptographic settlements during the initial wave of conflict holders, although Bitcoin has shown resilience later.

Merchants seem to be inclined bulls in the medium term, since BTC continues to support a pattern of higher minimums despite the intradic bobes. The profits about $ 106,000 limited the rising impulse, but the support of about $ 105,000 continues to attract buyers in DIPS. Market participants are closely observing this range, particularly because the safe demand and the feeling of risk remain intertwined.

While short -term holders continue to drive volatility, the broader structure suggests that BTC is consolidating instead of reverse. If the support of around $ 104,950 is maintained, Bitcoin can try another thrust above $ 106,200.

TECHNICAL ANALYSIS

- BTC quoted in a range of $ 2,090 of $ 104,182 to $ 106,272 in the last 24 hours.

- A key rebound occurred at $ 104,182 with 15,342 BTC negotiated during recovery.

- The resistance was formed about $ 106,200 in the middle of the consistent profits.

- A higher minimum line of minimum trend remains intact.

- Psychological support at $ 105,000 remains for now.

- Recent price range: $ 104,875 to $ 105,202 in the last hour.

- An acute sauce below $ 105k at 07:19 was quickly reversed, with $ 105,200 acting as a short -term resistance.

- The final 15 minutes candles showed a lower exhaustion, but the volume patterns suggest accumulation in the falls.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.