Cardano Ada

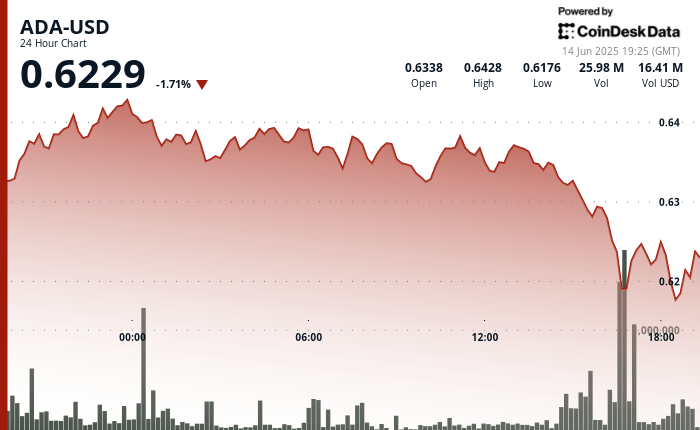

1.71% dropped in the last 24 hours, quoting to $ 0.6229 as of June 14. The asset fell briefly to $ 0.6176 before stabilizing, maintaining balance despite a strong wave of sale of large holders.

According to recent market data, whales have discharged more than 270 million ADA -worth approximately $ 170 million – in a movement that has added significant pressure to the action of the token price for a week marked by geopolitical volatility.

However, in the midst of mass sale, the Cardano Foundation presented a new product aimed at business adoption. On Thursday, the organization launched Originate, a blockchain based solution to verify the origin of the product and authenticity. Designed to help companies simplify compliance and protect against falsifications, originate allows companies to digitize and track critical product data into the chain, which allows instant verification by consumers and regulators.

On its website, the Foundation emphasized that Originate is built to strengthen the confidence of the brand in industries where the transparency of the supply chain is critical. By positioning itself as a tool for regulatory compliance and consumer guarantee, the product can help boost cardano reputation in business circles, especially at a time when investors seek cases of use of the real world beyond defi and bets.

The announcement occurs a few days after Ada was added to the Nasdaq Crypto index, joining Bitcoin and Ethereum. Although short -term feeling remains fragile due to the behavior of whale whales and macro trends, the institutional institutional profile of Cardano could provide longer -term support.

TECHNICAL ANALYSIS

- Ada ranged between $ 0.6176 and $ 0.6428, closing about $ 0.6229, a daily loss of 1.71%.

- The resistance remains strong about $ 0.642– $ 0.645, while the price broke below the support at $ 0.636.

- The heaviest volume peaks occurred after 18:00 GMT as the price fell below $ 0.62, which caused a brief sale of consolidation.

- The trend remains bassist with lower maximums that are formed throughout the day and rejection of $ 0.635.

- The price action suggests a short -term stabilization, but whales remain dominant when establishing the market management

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.