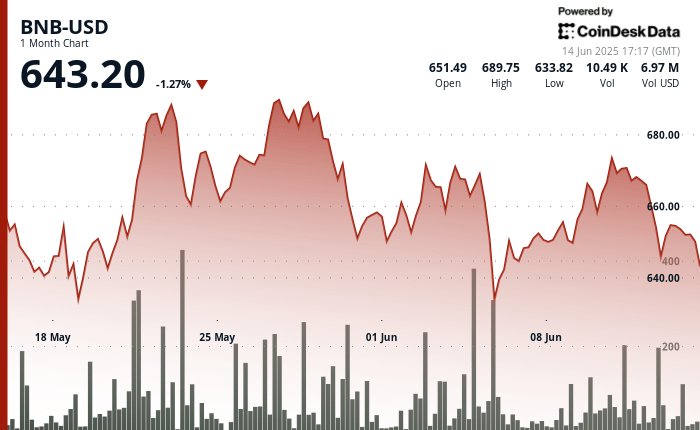

Binance Coin (BNB) is showing resilience after a stormy week for financial markets, since Israel attacked Iran in an attempt to limit its nuclear program and missile capabilities, which leads to a large -scale missile attack in response.

The conflict saw investors flee from risk assets and led to more than $ 700 million in liquidations in the cryptography market in just 24 hours, according to Coinglass. BNB, however, managed to maintain a narrow negotiation range of just over 1%, resisting a broader setback from Altcoin.

BNB, after the mass sale, did not break above $ 660, its immediate resistance level according to the technical analysis data model of Coindesk Research, and since then it has been consolidating within a symmetrical triangle pattern.

Despite the reverse, the currency has remained above the key support in $ 640, an area aligned with the Fibonacci recoil level of 78.6%. Negotiation volume analysis suggests that sellers dominate about $ 655.5, while a buyer base forms around $ 649, according to the model.

The technicians point out a mixed image. The divergence of the convergence of the mobile average (MACD) became negative, and the relative resistance index (RSI) is a little less than 50 years, hinting at the impulse of fading.

However, 50/200 days mobile averages approach a golden cross, and the Chaikin money flow indicator remains positive, a configuration that historically preceded the ascending reversals, according to the model.

But the feeling around BNB is not all optimistic. Net Taker Volume, an aggressive sales pressure indicator, reached a minimum of several weeks of -$ 197 million.

Meanwhile, even when the perpetual negotiation volume of Binance Smart Chain increased exponentially month by month, this activity does not seem to have caused a new demand for BNB. Futures’s open interest continues to decrease more than 30% since its December peak.