Bitcoin

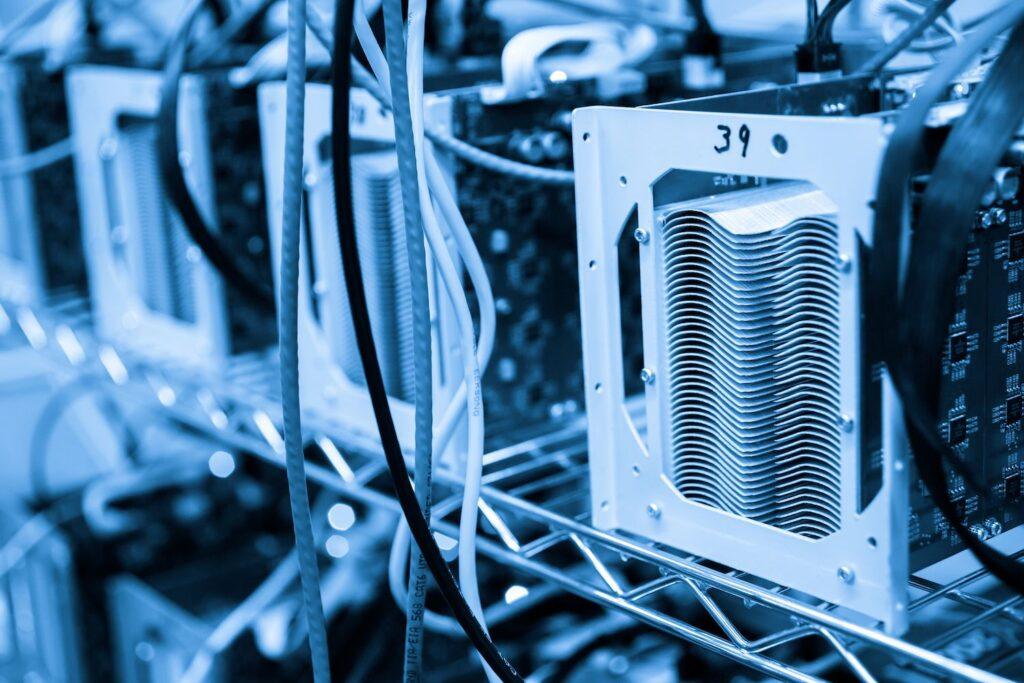

Miners face increasing pressure as the hashratate and the difficulty of the network continue to rise, adjusting the margins even when the price of Bitcoin remains stable, according to the monthly report of Theminermag.

The mining difficulty of the network reached a record of 126.98 billion, driven by an average hashrada of 14 days of 913.54 exahasos per second (EH/s). Transaction rates in June fell below 1% of block rewards, and hashprice fell to $ 52 per pH/s before bouncing slightly.

The growing competition and energy costs are expected to generate production expenses above $ 70,000 per BTC, compared to $ 64,000 in the first quarter of the year, according to the report.

To remain competitive, public miners such as Mara Holdings (Mara), Cleanspark (CLSK), Riot Platforms (Riot) and Iren (Iren) are accelerating the constructions. Mara increased her hashrate by 30% in May, while Hive (HIVE) added 32% after energizing a new installation in Paraguay. Encryption mining (enc) points to an impulse of 70% by expanding its Texas operation.

The upper level ASIC now cost between $ 10 and $ 30 per Terahash, according to the report, with operating recovery periods that extend up to two years. That involves an electricity rate of $ 0.06/kWh, already out of the reach of some. Terawulf, for example, paid $ 0.081/kWh in the first quarter, which increased the hashost of its fleet by more than 25%.

Meanwhile, mining shares are decoupling Bitcoin’s price performance. Iren, Core Scientific (Corz) and Bit Digital (BTBD) were in the Green during the last month, while Canaan (Can) and Bitfms (Bitf) were low of double digits during the same period of time.

The change suggests that investors are paying more attention to business models instead of only Bitcoin’s price action.