Cardano Ada

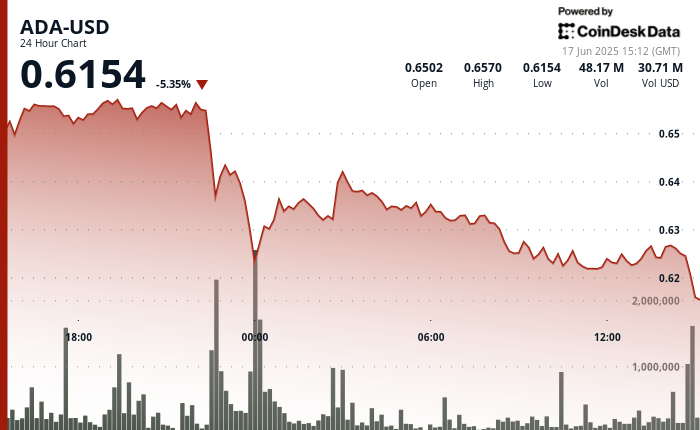

Token quoted at $ 0.6154 on Monday afternoon, extending its decline to 5.35% in the last 24 hours. The Token constantly fell through multiple levels of support after a sales sale at the end of session began around 22:00 UTC on June 16. Despite a brief attempt to recover at the beginning of the session, the bearish structure remained intact at noon on Tuesday.

Correction reflects broader risk behavior in digital assets as global macroeconomic conditions remain tense. Commercial disputes and monetary adjustment in the main economies have added pressure to risk markets, dragging Ada and other lower capitalization tokens.

Even so, some technical analysts have pointed out possible signs of a reversal in ada’s structure. A brief rebound of $ 0.622 to $ 0.626 before in the session formed a small inclination channel up, with a price that proves the band of $ 0.624– $ 0.625 several times. That area has now become a potential pivot zone, although the volume has been reduced since then and volatility has been reduced.

With the SEP trade just above their minimum daily, the bulls are observing the stabilization of around $ 0.615– $ 0.620. A clear directional movement from here can depend on whether that support area is maintained and if the broader conditions of the market begin to recover.

TECHNICAL ANALYSIS

- A strong decrease began at 22:00 UTC on June 16 when Ada broke below the support level of $ 0.650 at high volume.

- Multiple attempts to claim $ 0.630 created a new resistance band about $ 0.640.

- Lower highs formed with each rebound, confirming the pressure down throughout the period.

- A support zone was developed between $ 0.620 and $ 0.622 as the volume was collected at those levels.

- The price entered a descending channel with lower and lower minimum lower ups and downs.

- A brief recovery of $ 0.622 to $ 0.626 created a micro channel of ascending slope in the middle of an increasing volume.

- The resistance was formed at $ 0.626, with the area of $ 0.624– $ 0.625 that acts as a pivot range during repeated tests.

- Recent candles showed a decrease in volatility and volume, indicating consolidation near local minimums.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.