Ether (eth)

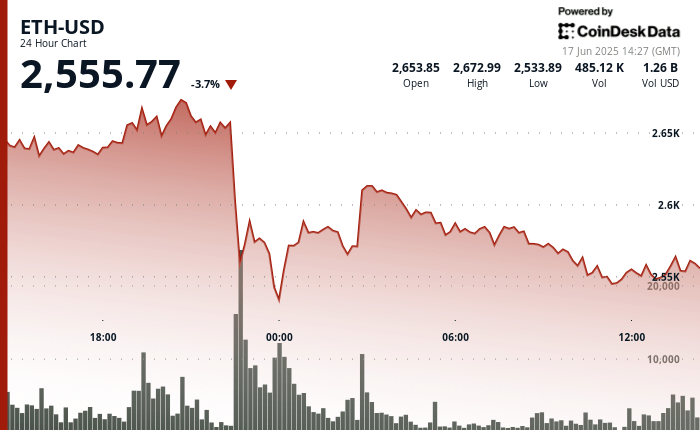

It was negotiated at $ 2,555.77 on Tuesday, 3.7% less in the last 24 hours after a strong rejection near the level of $ 2,673 triggered a sales wave. The recession follows several impulse sessions in decline and increasing volatility, which culminated in a large sale on Monday night that broke the initial support and left prices on a trend down for most of the day.

Despite this weakness in the price action, the data in the chain suggest that the largest participants in the market continue to deal with the decline as an opportunity to accumulate. According to Glassnode, the accumulation of daily net whales has exceeded 800,000 ETH for almost a week, with total holdings in 1,000 to 10,000 ETH wallets that increase above 14.3 million. The larger day entrance occurred on June 12, when whale wallets added more than 871,000 eth, the largest net input of 2025 so far.

This accumulation trend reflects the behavior for the last time in 2017, underlining the scale and intensity of the recent purchase of large holders. The shopping spree of whales has coincided with the withdrawal of Ethereum of the levels of $ 2,700 and can reflect strategic positioning before additional developments in institutional flows or catalysts related to the ETF.

While technicians remain under short -term pressure, the magnitude of this purchase activity indicates a growing conviction between large entities. With prices around the key support, merchants and analysts are watching closely to see if this accumulation driven by whale translates into a short -term reversion or simply cushions below.

TECHNICAL ANALYSIS

- ETH fell 5.7% of $ 2,679.99 to $ 2,527.37 during the negotiation session of June 16, with a volume greater than 560,000 ETH.

- There was an acute fall during 10:00 p.m., confirming the resistance to $ 2,650 and accelerating the downward impulse.

- The subsequent recovery was arrested about $ 2,540, forming a narrow consolidation pattern with reduced volatility.

- During the last hour of the analysis window, ETH rose from $ 2,550.57 to a peak of $ 2,564.28 before stabilizing about $ 2,553.40.

- An increase in volume at 13:30 saw more than 12,200 ETH that were negotiated, which led to a brief recovery of 1.6% to $ 2.561.59.

- A setback followed, finding support to $ 2,549.56 during candle 13:44; Price Action formed an ascending channel with buyers intervening.

- The area of $ 2,553– $ 2,555 emerged as a key level of intraperyiod consolidation during the recovery phase.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.