Bitcoin Cash (Bch)

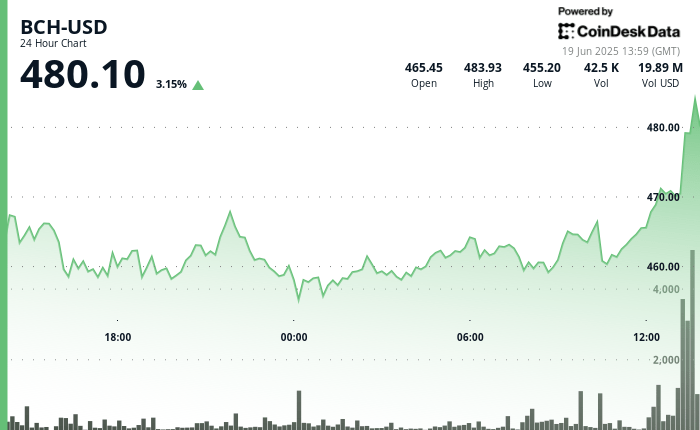

It rose 3.15% in the last 24 hours to $ 480.10, rising abruptly from a minimum session about $ 454 after buyers intervened to reverse early weakness, according to the technical analysis model of Coindesk Research.

While much of the cryptography market fought under the pressure of world economic tensions and the decrease in Bitcoin prices, BCH exploded upwards in the session as the volume and short -term resistance levels increased.

The measure occurred in the midst of an increase of 21.98% in the 24 -hour negotiation volume versus the average of 30 days, confirming a change in participation and pointing out that operators were positioned in resistance. The key purchase activity occurred during the morning hours of the United States, with multiple volume peaks between 08:00 and 12:20 UTC. The final thrust above $ 468 was fed by aggressive purchases in the last hour of the analysis window.

Despite the winds against broader, including a 3.5% decrease in the total capitalization of the cryptographic market and the growing commercial tensions of the United States-China, it was assigned to its relative resistance. The recovered levels of the currency were lost earlier this week and ended up near the maximum of the day, with a clear pattern of higher minimums and sustained accumulation in each break. While short -term volatility can continue, BCH enters the next session with visible impulse and new support.

TECHNICAL ANALYSIS

- BCH quoted in a 24 -hour range between $ 454.16 and $ 469.06, a Swing of 3.26%.

- The day began with a drop to $ 454 in the volume higher than the average (41k), but a rebound formed a base at $ 455– $ 458.

- Volume peaks during 08: 00–10: 00 pointed out an increase in buyer’s interest, helping to raise the price level of $ 468.

- The final time saw a break of $ 462.75 to $ 468.77 (+1.3%), followed by a strong continuation to $ 480.10.

- The notable volume on the purchase side came at 11:27 (1,314 units), 12:15 (718 units) and 12: 20–12: 21 (more than 3,600 units in total), confirming the demand.

- A bullish trend formed with higher and higher high ups and dotter, strengthened by the sustained volume at the closure.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.