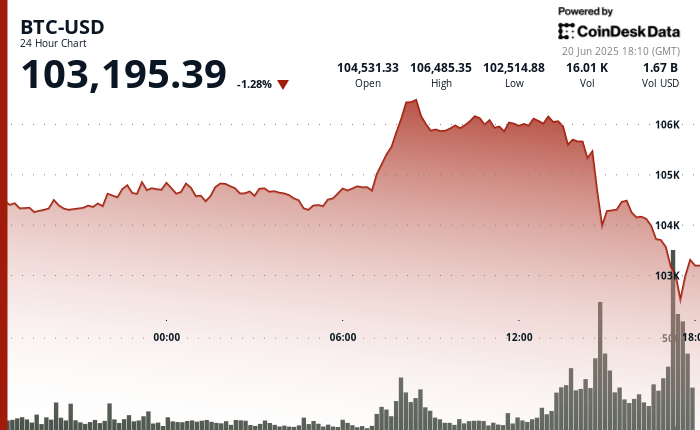

What began as a positive day for cryptographic markets was quickly invested during the US session. With Bitcoin

Sliding below $ 103,000 from the level of $ 106,500 only a few hours earlier.

At the time of publication, Bitcoin had reduced some of the losses, returning to $ 103,200, 1.2% in the last 24 hours.

Other large cryptocurrencies suffered more pronounced decreases. Ethereum’s Ether

He saw a strong fall of 4.5% in just 90 minutes up to $ 2,372, with a negotiation volume that increases to almost 800,000 eth, almost eight times the average volume per hour, according to Coindesk data. Solana’s Sol, Dogecoin and Cardano’s Ada were 3% -5% lower during the same period.

The explosion of volatility caught many merchants offside, liquidating around $ 450 million in derivative negotiation positions in centralized exchanges in all digital assets, as shown in caramel data. About $ 387 million of liquidations were linked to long positions that bet to benefit from prices.

While macro risks abound, including the continuous conflict between Israel and Iran, there was no immediate external reason for sudden price swing. The S&P 500 and Nasdaq 100 indices only decreased during the day.

Bitcoin in Stalemate

When removing, BTC continues to operate within a side range between $ 100,000 and $ 110,000, consolidating just below its registration level of all time.

“The mixed vision of whether BTC will exceed $ 110,000 or will fall into the $ 90,000 area does not surprise me at all and underlines the general indecision that people and markets feel,” said James Toledano, director of Operations of Unity Wallet.

“The present stagnation of the BTC reflects a market trapped between the long -term upward feeling and the macroeconomic and geopolitical uncertainty in the short term,” he added.