Bitcoin (BTC)

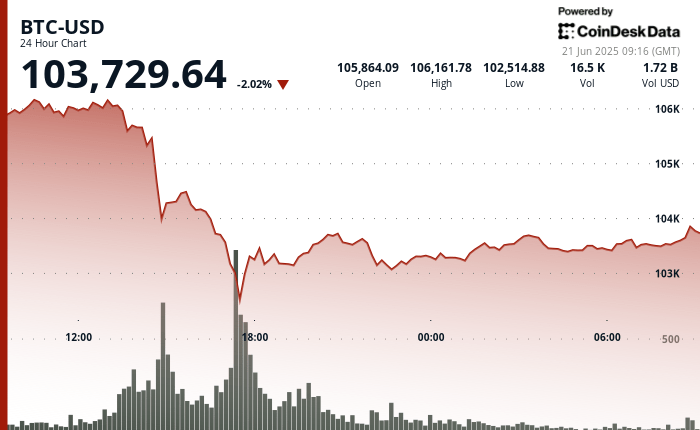

He continues to fight for the direction in the midst of the growing macroeconomic pressures and a notable deterioration in the feeling of retail investors. The asset is around about $ 103,700 after a 24 -hour stretch volatile, in which it fell briefly below $ 103,400 before organizing a modest recovery, according to the Coindensk Research technical analysis model. This price behavior reflects a backdrop of the awkward market, formed by both geopolitical tensions and uncertain monetary policy.

According to an X position of the Santimento cryptographic analysis firm on Thursday, the feeling among retail investors has become very negative. The firm informed that the proportion of bullish comments to bassists has fallen to only 1.03 to 1, the lowest since the beginning of April, when President Donald Trump announced his so -called liberation day tariffs, which caused the fear of the maximum market at that time.

Santiment emphasized that this current wave of retail pessimism is unusually intense and, based on past patterns, can mark a opposite signal for a price rebound. They specifically pointed out that in April, Bitcoin recovered shortly after similar levels of fear arose, which suggested that great investors often use periods of retail capitulation to accumulate at favorable prices.

To the pressure is added the recent decision of the Federal Reserve to maintain stable interest rates, which has kept Btcoin operating in a relatively adjusted range of $ 100,000 to $ 110,000 during the last month. Meanwhile, chain metrics show a decrease in open interest in Binance, noting that it continues to disappear among derivative merchants. At the same time, whale wallets have shown a constant accumulation since 2023, an indication that the great headlines continue to build their positions despite short -term uncertainty.

TECHNICAL ANALYSIS

- BTC-USD quoted in a 24-hour range between $ 106,552.98 and $ 102,411.01, a 3.89% swing as volatility with increase at noon.

- There was an acute fall between 14:00 and 17:00 UTC, which pushed the price below $ 104,000 and formed a strong resistance about $ 106,000 in the volume higher than the average.

- The support arose between $ 103,000 and $ 103,500, where the price was consolidated in the decrease in volume during the final eight hours of the analysis period.

- A V -shaped rebound was developed at the end of the session, with BTC increasing from $ 103,363 to $ 103,618 and establishing a local floor about $ 103,500.

- The short -term impulse indicators showed a mild recovery when the session closed near the maximum intradic, but the follow -up remained limited.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.