Bitcoin

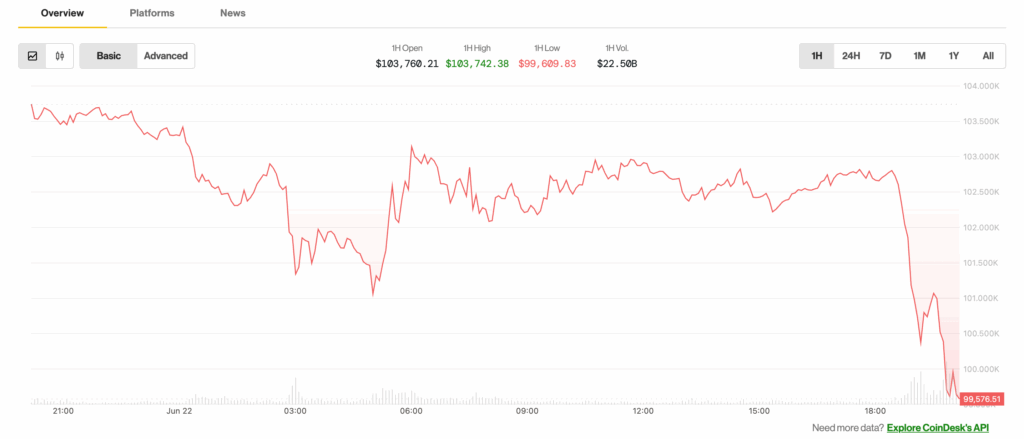

It fell below $ 100,000 on Sunday, its lowest point since May, indicating risk aversion on Wall Street on Monday in the middle of reports that Iran lean towards the blockade of the hormuz narrow.

The Strait, located between Oman and Iran, connects the Persian Gulf with the Gulf of Oman and the Arabic Sea, managing approximately 20% of world oil trade.

The reports of Iranian politicians who reflect at the close of the Strait had worried observers for a significant increase in oil prices on early Monday.

“After the USA. Uu. Last night in Iran, more than 50 large oil tankers were struggling to leave the hormuz narrow. The markets have closed, but an immediate fall is expected in the offer to send higher prices. JP Morgan described this as his worst scenario in the Israel-Iran War,” said Kobeissi’s letter in X. in X.

According to JPMorgan, oil could obtain $ 120- $ 130 per barrel in that scenario. That could raise the inflation rate of the United States to 5%, the highest since March 2023. At that time, the Federal Reserve was increasing interest rates.

BTC losses weighed a lot about the largest cryptographic market, as usual, dragging the main alternatives such as XRP, Sun and ETH lower ETH. The XRP focused on payments fell 6% to $ 1,935, the lowest since April 10. Ethereum’s ether token fell to the levels observed in early May, according to Coindesk data.