Bitcoin Cash (Bch)

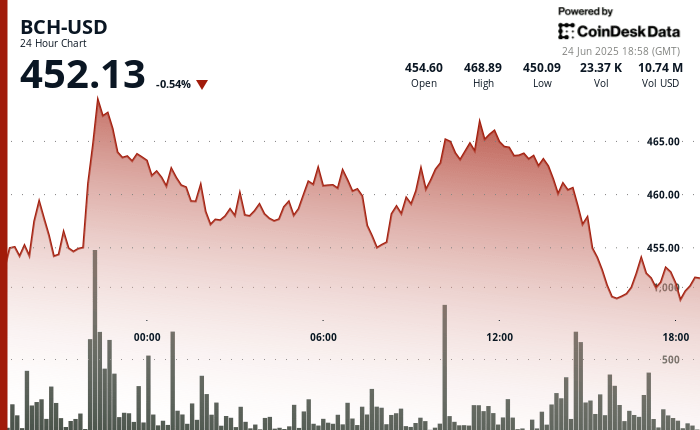

It is quoted at $ 452.13, 0.54% less in the last 24 hours, after not breaking the resistance level of $ 467 in multiple tests, according to the technical analysis model of Cindensk Research.

The Token briefly approached that level at the end of June 23, winning almost 3% for a high volume peak, but was subsequently rejected twice, reinforcing the importance of that barrier. A line of descending trend was formed during corrective setback, with lower maximums that establish a short -term bassist tone.

In the regulatory front, the president of the Federal Reserve, Jerome Powell, announced that US banks now have the freedom to determine their digital asset client base without prior regulatory approval. This policy change effectively eliminates institutional adoption barriers and is considered a significant step towards a greater integration of cryptography into the traditional financial system.

TECHNICAL ANALYSIS

- BCH quoted in a range of $ 19.76 (4.4%) of $ 449.61 to $ 469.63 for 24 hours.

- At 22:00 of June 23, BCH increased almost 3% by 79,485 units of volume, establishing resistance to $ 467.

- The level of $ 467 was tested and rejected twice, confirming strong resistance to general expenses.

- The support was formed around $ 450 with a significant volume accumulation between 15: 00–16: 00.

- A line of descending tendency of the lower maximums after the initial spike arose, pointing out the bassist impulse.

- A V -shaped micro trend was formed during the final time, with a rebound of $ 449.94 to $ 451.31.

- Increased volume during 18: 17–18: 19 it falls and again in recovery 18: 30–18: 32.

- A short -term support zone was developed by about $ 450 after repeated successful reestimations.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.