Bitcoin

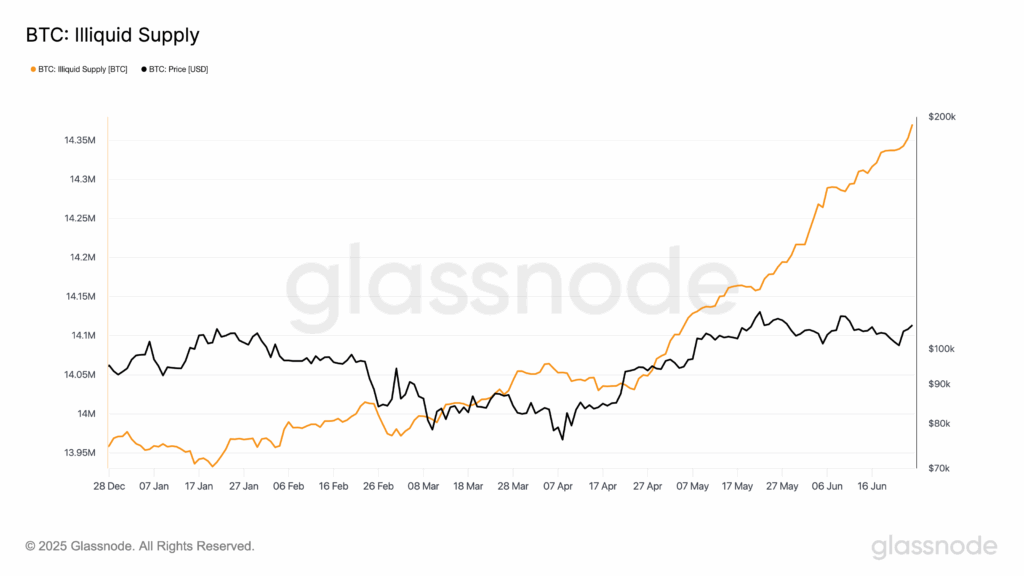

The Illiquid supply has increased to 14.37 million BTC, jumping from 13.9 million BTC at the beginning of 2025, according to Glassnode data.

With the current circulating supply of Bitcoin in approximately 19.8 million, this means that more than 72 percent of all minted BTCs are now classified as ilíchides.

The Illicid supply refers to the portion of BTC held by entities with minimal spending behavior, such as long -term investors and cold wallet holders. These currencies are effectively removed from the market, reducing the amount available for trade.

As more investors choose to store bitcoin instead of exchanging it, the liquid part of the supply is shrunk, adjusting the availability of the market.

This trend is significant because an increasing illegid supply often reflects the growing confidence of investors and long -term condemnation. It also creates the potential of a shock on the supply side, where the growing demand meets the limited supply available, historically associated with bullish price movements.

The continuous increase in Bitcoin’s illiquidity supports Bitcoin’s narration as a value reserve. If this trajectory is maintained, it could exert ascending pressure on the price, particularly in the context of greater interest in the market and a decrease in the issuance of miners.

This underlines liquidity analysis as a key indicator for market feeling and future price action.