Bitcoin

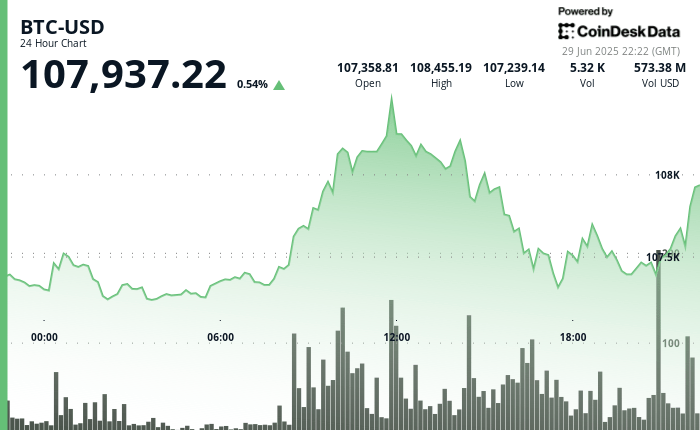

He quoted at $ 107,937 at 22:22 UTC on Sunday, 0.54% in the last 24 hours, as the attention resorted to fiscal policy tensions in Washington after President Trump’s last position on Truth Truth Social.

The price action remained volatile, with BTC fluctuating between $ 107,194 and $ 108,489 during the 24 -hour window, according to the technical analysis model of Coindesk Research.

On June 29, 2025, President Donald Trump published a pointed message about the social truth that is addressed to Republican legislators in the midst of an intense debate about his wide package of taxes and expenses. “For all costs of cost cutting, of which I am one, remember, you still have to be re -elected. This statement underlines the deep divisions within the Republican party while fighting with the ambitious legislation called” a great project of beautiful law. “

The bill, exceeding 900 pages, combines approximately $ 3.8 billion in tax cuts with reductions of specific expenses and higher funds for border defense and safety. It seeks to make permanent many of the tax exemptions of the Trump 2017 Tax and Jobs Reduction Law, including the disposal of tips on tips, the payment of overtime and certain loans for automobiles. The children’s tax credit would increase to $ 2,200 under the version of the Senate, while deductions for older people would temporarily increase. However, to compensate for these tax cuts, Republicans propose significant cuts to Medicaid and Nutrition programs, which caused a fierce debate within the party.

The moderate Republicans of the high -tax states are pressing for a higher limit in state and local tax deductions (SALT)While conservatives demand deeper expenses, particularly aimed at Medicaid. These internal disagreements complicate the efforts to ensure the necessary republican majorities necessary in both chambers to approve the bill, to which the Democrats oppose uniformly as favoring rich inequitality and worsening.

The message of Trump’s social networks reflects an attempt to balance these competing pressures, urging tax restriction to satisfy conservatives while emphasizing that robust economic growth will compensate for income losses and help reduce deficits over time. This economic approach on the supply side projects that the growth “achieves everything” despite the short -term increases in national debt, which non -partisan analysts estimate who could add billions to the existing debt of $ 36.2 billion.

Crypto Analyst Will Clemente Clemente’s reaction in X (previously Twitter) Shortly after Trump’s publication, he captures a common feeling of the market: “How can you read this and have in the long term of the US treasures. Uu. In current yields hahaha … too, how can you read this and not have any bitcoin or gold”? Clemente’s skepticism towards the United States Treasury Bonds in the long term reflects the concerns that the tax cuts financed by the bill of the bill and the modest expenses of expenses indicate a loose fiscal policy that could feed the inflation and the degradation of currencies.

In this context, traditional fixed income assets such as treasure bonds may seem less attractive, since increasing deficits and monetary accommodation threaten bond values. On the contrary, hard assets such as gold and bitcoin look more and more as value stores and hedges against inflation and fiscal risk. The expectation of sustained deficits and political challenges for fiscal discipline reinforces the demand of these assets resistant to inflation.

With the Senate race to end the bill before the holidays of July 4, Trump’s call for unity and moderation highlights the high bets and political challenges by approving one of the most consistent tax packages in the recent history of the United States. The destination of the bill remains uncertain since legislators negotiate to balance tax deduction, expense cuts and political viability.

TECHNICAL ANALYSIS

- From June 28, 15:00 to June 29, 14:00 UTC, BTC quoted from $ 107,194 to $ 108,489, an intradic range of 1.21%.

- The support was established at $ 107,300, with multiple rebounds during the 02: 00–03: 00.

- The volume reached its maximum point at 7,538 BTC between 08:00 and 11:00 UTC on June 29, confirming the upward impulse.

- During the last hour of the session (13: 05–14: 04 UTC)BTC fell from $ 108,219 to $ 108,059, forming a descending channel.

- A volume peak of 130 BTC at 13:35 coincided with a strong drop at $ 108,030, which was tested and retained.

- The Final Intradía Rally withdrew the price towards $ 108k before fading slightly at 22:22 UTC to $ 107,937.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.