- Invoice will add $ 3.4 billion to the US debt. For a decade.

- It contains many of Trump’s main national priorities.

- DEM JEFFRIES establishes a record with 8 -hour challenging speech, 46 minutes.

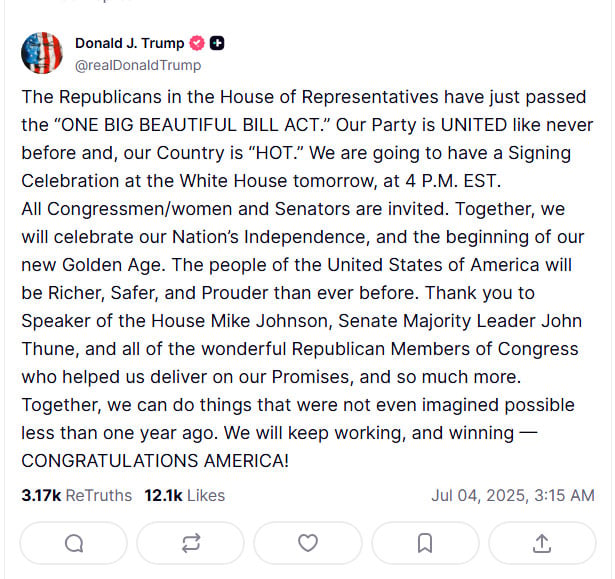

The president of the United States, Donald Trump, will sign his massive tax and expenses back of law on Friday at 5 PM (ET), at 3 am on Saturday (PST), marking a great political victory after deleting the congress by little, delivering radical breaks for corporations and rich while cutting the health coverage by millions.

Voting 218-214 is equivalent to a significant victory for the Republican President, which will finance its repression of immigration, will make its 2017 tax cuts permanent and will deliver new tax exemptions that it promised during its 2024 campaign.

It also reduces food and safety networks programs and address dozens of green energy incentives. He would add $ 3.4 billion to the debt of $ 36.2 billion of $ 36.2 of the country, according to the budget office of the non -partisan congress.

Despite the concerns within Trump’s party about the price of the 869 pages bill and their impact on medical care programs, in the end, only two of the 220 Republicans of the Chamber voted against, after a confrontation during the night. The bill has already eliminated the Senate controlled by Republicans by the narrowest possible margin.

The White House said Trump will sign it in the law at 5 pm et (2100 GMT) on Friday, the holidays of the Day of Independence of July 4.

Republicans said legislation will reduce taxes for Americans throughout the income spectrum and stimulate economic growth.

“This is a fuel for airplanes for the economy, and all ships will increase,” said the president of the House of Representatives, Mike Johnson.

All Democrats in Congress voted against, expelling the bill as a raffle of the rich that would leave millions without insurance.

“The approach to this bill, the justification of all the cuts that will harm everyday Americans, is to provide massive tax exemptions for billionaires,” said the Democratic leader of the House of Representatives, Hakeem Jeffries, in a speech of eight hours and 46 minutes that was the longest in the history of the camera.

Trump kept the pressure at all times, coating and threatening legislators while pressed to finish the job.

“For Republicans, this should be an easy vote of itself. Ridiculo!” He wrote on social networks.

Although approximately a dozen Republicans from the House of Representatives threatened to vote against the bill, only two ended up doing it: Brian Fitzpatrick of Pennsylvania, a centrist, and Thomas Massie de Kentucky, a conservative who said he did not reduce enough.

Marathon weekend

The Republicans ran to meet Trump’s deadline of July 4, working during the last weekend and celebrating debates throughout the night at the Chamber and the Senate. The bill approved the Senate on Tuesday in a 51-50 vote, since Vice President JD Vance cast the broken vote.

According to the CBO, the bill would reduce tax revenues by $ 4.5 billion for 10 years and reduce spending by $ 1.1 billion.

These expense cuts come largely from Medicaid, the health program that covers 71 million low -income Americans. The bill would harden the registration standards, would institute a work requirement and pressed a financing mechanism used by the States to increase federal payments, changes that would leave almost 12 million people without insurance, according to the CBO.

Republicans added $ 50 billion for rural health suppliers to address concerns that these cuts would force them to get the business.

Non -partisan analysts have discovered that the richest Americans would see the greatest benefits of the bill, while low -income persons would effectively see that their income falls as safety network cuts would exceed their tax cuts.

Analysts say that the increase in debt load created by the bill would also effectively transfer money from younger generations to older. The Moody’s grades firm reduced US debt in May, citing the growing debt, and some foreign investors say that the bill is making the United States Treasury bonds less attractive.

The bill collects the roof of the US debt. UU. At $ 5 billion, avoiding the perspective of a short -term breach. But some investors concern that debt overhabit can reduce the economic stimulus in the bill and create a long -term risk of higher indebtedness costs.

On the other side of the main book, the bill eliminates tax increases that should affect most Americans at the end of this year, when Trump’s individual and commercial tax cuts in 2017 had to expire. These cuts are now made permanent, while tax exemptions for parents and companies are extended.

The bill also establishes new tax exemptions for tips, payment of overtime, older people and cars loans, complying with Trump campaign promises.

The final version of the bill includes more substantial tax cuts and more aggressive medical care cuts than the initial version approved by the camera in May.

During the deliberations in the Senate, the Republicans also eliminated a provision that would have prohibited the regulations at the state level on artificial intelligence and a “retaliation tax” on foreign investment that had caused alarms on Wall Street.

It is likely that the bill appears prominently in the mid -period elections of 2026, when the Democrats hope to recover at least one Chamber of Congress. Republican leaders argue that the tax exemptions of the Goose bill before then, and many of their benefits cuts are not scheduled to take action until after that election. Opinion surveys show that many Americans are concerned about the cost of the invoice and its effect on low -income people.