Internet computer protocol

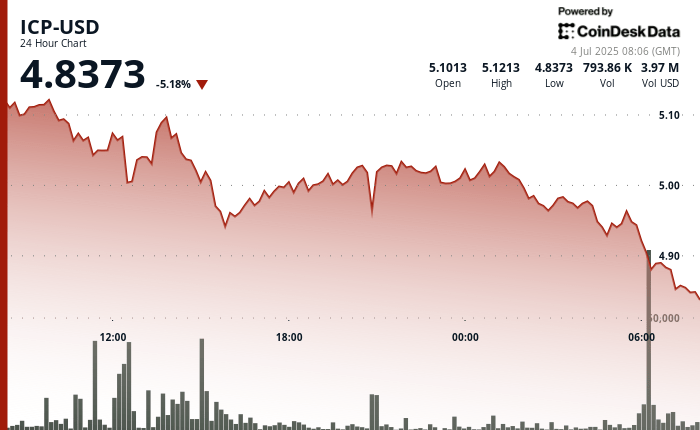

It is quoted at $ 4,8373, 5.18% less in the last 24 hours, while the broader cryptographic market according to the Coendesk 20 index fell only half.

ICP faced a renewed sales pressure such as geopolitical risks and cybersecurity threats in digital asset markets. The decrease occurs in the midst of the worrying findings of the Koi Security cybersecurity firm, which discovered a malicious browser extensions network aimed at cryptocurrency users.

The report identified more than 40 Firefox false accessories designed to imitate popular wallets such as Metamask and Coinbase. It is believed that these extensions, some of which remain live in browse stores, have stolen credentials sensitive to off users since at least April 2025.

Technical metadata and language artifacts in attack infrastructure point to Russian speech actors, according to Koi. These findings added a new layer of concern for cryptographic investors who were already navigating the macroeconomic uncertainty and fragmented global regulation.

The ICP price reaction was fast, with the Token falling through the key support for $ 5.00, according to the technical analysis model of Cindensk Research. The bearish movement was amplified by the increase in negotiation volumes during key settlements at 12:00 and 20:00 UTC on July 3. The vulnerability of the currency to a broader feeling of risk was in full exhibition, since the cyber threat narrative crossed with high volatility to boost very low prices.

The attack of the false wallet, when exploiting the same layer of trust, depends on the users of digital assets, has increased awareness about safety risks in decentralized ecosystems. For projects such as the Internet Computer, which promote infrastructure in chain and self -ustody, the risk of reputation of this type of exploits can greatly weigh the feeling of investors, even when it is not directly linked to the protocol itself.

TECHNICAL ANALYSIS

All time mentioned are UTC.

- ICP-USD decreased 4.3% to $ 4,8373 between July 3 07:00 and July 4 06:00.

- Price Action formed a descending channel, with resistance about $ 5.13 and a decisive breakdown below $ 5.00.

- Acute sales occurred at 12:00 and 20:00 on July 3, accompanied by a volume higher than the average.

- The general range of Token was $ 0.26 (5.1%)underlining augmented volatility.

- There was a drop of 1.17% between 05:52 and 06:51 on July 4, with the submerged price below $ 4.90.

- Temporary support arose at $ 4.88 around 06:30, followed by a slight recovery that stops at $ 4.89.

- The volume exceeded 94,000 units during window 06: 27–06: 30, probably driven by institutional activity.

- The final minutes showed consolidation, with low volatility that suggests a possible range action ahead.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.