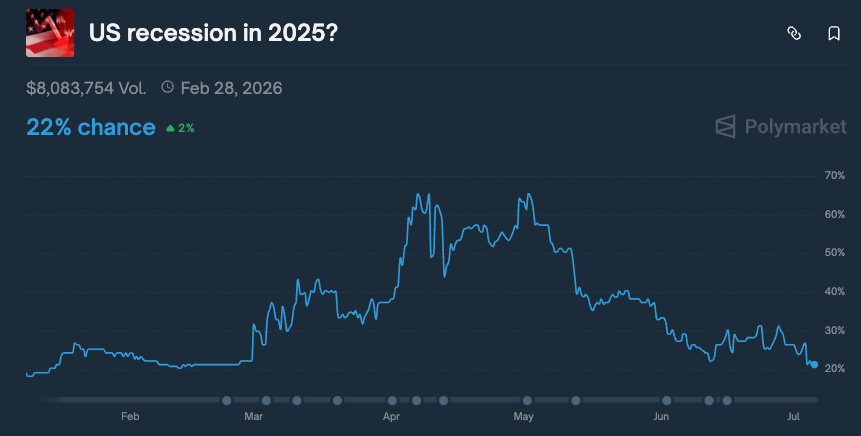

Bets in a recession of the United States in 2025 have fallen abruptly, with probabilities on the cryptography prediction platform that sinks at 22% this week, the lowest level since the end of February.

The fears of recession were fired earlier this year when the GDPnow indicator of the Atlanta Federal Reserve predicted a 1.5% contraction for the first quarter of the year, while the real fall was softer to 0.5%.

Tensions intensified in March when the president of the United States, Donald Trump, announced a series of reciprocal tariffs on what marked the “day of liberation”, investors already distrust a decelerating economy. The Fed decision of stopping the rhythm of reducing its balance sheet added fuel to concerns.

In April, the Wall Street giants like Goldman Sachs and JPMorgan were raising red flags. Goldman put the probabilities of recession at 45% at that time, and Polymarket’s probabilities rose to 66%. Another peak arrived in May after the former United States Treasury Secretary, Janet Yellen, warned that Trump’s tariffs could have a “tremendously adverse” effect on the economy.

However, behind the headlines, negotiations with China progressed. The market coined to the call Wad (Trump always leaves the chicken) tradereferring to the pattern of negotiations of the president of the United States, where tariffs are announced but then invest.

Goldman Sachs reduced his recession probabilities from 12 months to 30% last month, reflecting a more optimistic perspective as financial conditions decreased and commercial threats retreated.

If a recession arrives in 2025 it is still uncertain. In Polymket, a recession commitment pays whether the National Economic Research Office declares one or if the United States publishes two consecutive quarters of negative GDP growth.