Dogecoin registered a powerful 6% increase during the negotiation session from July 9 to 10, exploiting the resistance in an explosive rally before retiring in a strong investment from the late session.

News background: Commercial pause pause and bara fuel ralision

- The feeling of the market improved after the United States extended its rate deadline for the “release day” in three weeks, the purchase time for commercial negotiations and facilitating short -term pressure on risk assets.

- Meanwhile, the expectations of a Julio Fed rate cut are uploading, with the main price fixing banks at 25-100 bp in cuts on Q3 if inflation data rises to next week.

- These macro changes gave cryptographic markets a tail wind, helping Doge and other high beta assets to bouncing sharply from the key support levels.

Summary of the price action

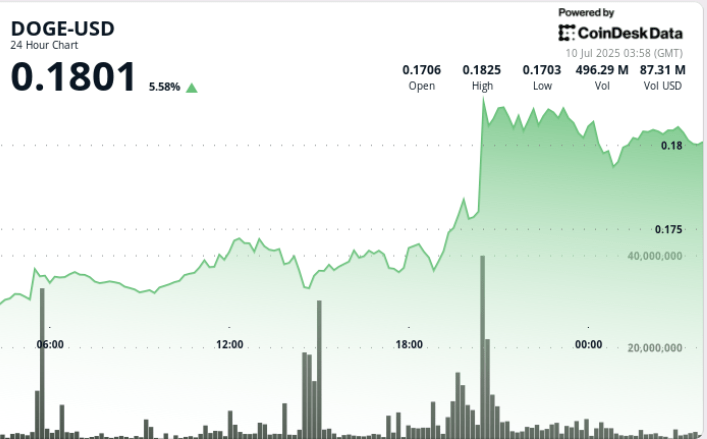

- Doge increased 6% of $ 0.170 to $ 0.186 between July 9 03:00 and July 10 02:00.

- The rupture occurred between 19: 00–20: 00 July 9, where the price increased $ 0.007 and the volume increased to 1.52b, almost double the average of 24 h.

- The strong resistance arose at $ 0.186 since the price was repeatedly rejected in a heavy volume.

- The support kept around $ 0.180– $ 0.181 at the close of the session.

- In the last hour (02: 28–03: 27), Dege fell 0.55% of $ 0.181 to $ 0.180, forming an acute investment pattern with a downward impulse.

Technical analysis

- Range: $ 0.016 or 9.23% between $ 0.170 minimum and $ 0.186 high.

- Resistance: Pico of $ 0.186, with repeated high volume rejection for 21: 00–23: 00.

- Support: $ 0.180– $ 0.181 area maintained in closure, but fractured during the sale of the final hour.

- Breaks: 02: 28–03: 27 Session saw support levels of $ 0.1808, $ 0.1806 and $ 0.1803 Rupture consecutively low heavy sales volume – Signaling of the institutional distribution.

- Volume: 1.52b in Breakout, 4.9m during the final investment, confirming both the entrance of the bull and the output of the bear.

What merchants are seeing

- Can Doge recover $ 0.186 and turn support for support? Be attentive to the sustained volume above this level.

- If the disadvantage continues, $ 0.176 and $ 0.172 are the next potential support levels of the previous consolidation zones.

- RSI and obvious readings in the lowest terms suggest short -term exhaustion, but the macro feeling remains a net reach.

- The range of July 9 to 10 could form the “mango” in a larger weekly weekly and weekly handling pattern: the validation would require a break above $ 0.195 with high volume.

Carry

Doge seems to be rolled up for a break. Several bullish technical patterns, which include a cup of several years and a higher, higher and triple background base, align with an increase in the institutional accumulation of whales.

A decisive movement above the resistance zone of $ 0.175– $ 0.20, especially with volume peak, could trigger a powerful rally towards $ 0.25 and more.

(Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the accuracy and fulfillment of our standards. For more information, consult the complex policy of COINDESK).