BNB is closer to the $ 700 brand as merchants responded to a new tokens burn of $ 1 billion and growing interest in the use of the asset as a reserve of the corporate treasure.

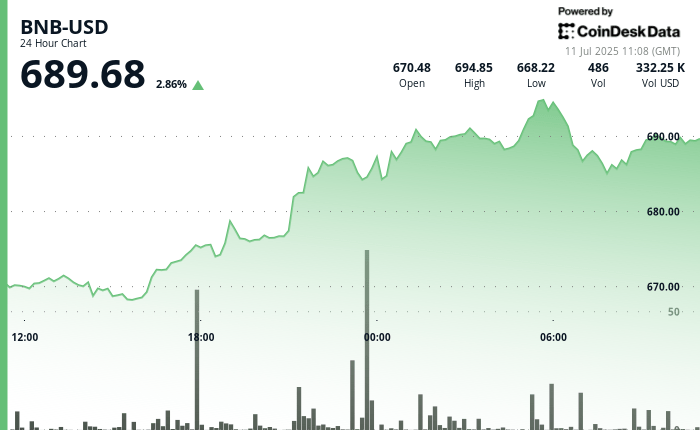

During the last 24 -hour period, BNB increased around 2.8%, from $ 670.40 to $ 688.7. The trade increased as the price increased, in the midst of a broader rally in the cryptocurrency market that saw Bitcoin reach a new time all over $ 118,000.

The price briefly reached an intradic peak about $ 695 before settling in a narrow range around $ 689.

The Wally was not fed by rising cryptocurrencies. Binance’s quarterly burn 32 permanently eliminated around 1.59 million BNB of the circulation, which brought the total value burned to 265,605 BNB according to a monitoring website.

Burns are part of a deflationary strategy with the aim of reducing the total offer to 100 million tokens.

In addition to this, more than 30 teams are working on ways of structuring public company treasury reserves in BNB, with the investment firm 10x capital that supports a plan for a BNB Treasury company of $ 500 million in the United States.

According to Nansen Data, the active addresses in the BNB chain have doubled since March, around Nansen’s data. Similarly, the average volumes of daily transactions have tripled.

Investors are observing to see if BNB can decipher the psychological barrier in $ 700 in the next few days.

General description of the technical analysis:

- BNB won 2.77% during the 24 -hour period, indicating a solid ascending impulse, according to the technical analysis model of Coindesk Research.

- The price varied $ 27.51 (4.11%) between a minimum of $ 667.61 and a maximum of $ 695.12.

- The negotiation volume increased to 155,426 chips at the close of yesterday’s negotiation, more than double the 24 -hour average of 64,169.

- The resistance is visible about $ 695.12, while the support has emerged around $ 667.61.

- After the initial rally, prices were consolidated within a narrow band of $ 1.51 of $ 688.81 to $ 690.73.

- The strong support has been resolved near the area of $ 688.80- $ 689.00.

- The market briefly tested the resistance at $ 690.73 before relaxing in a controlled setback.

Discharge of responsibility: Parts of this article were generated with the assistance of AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.