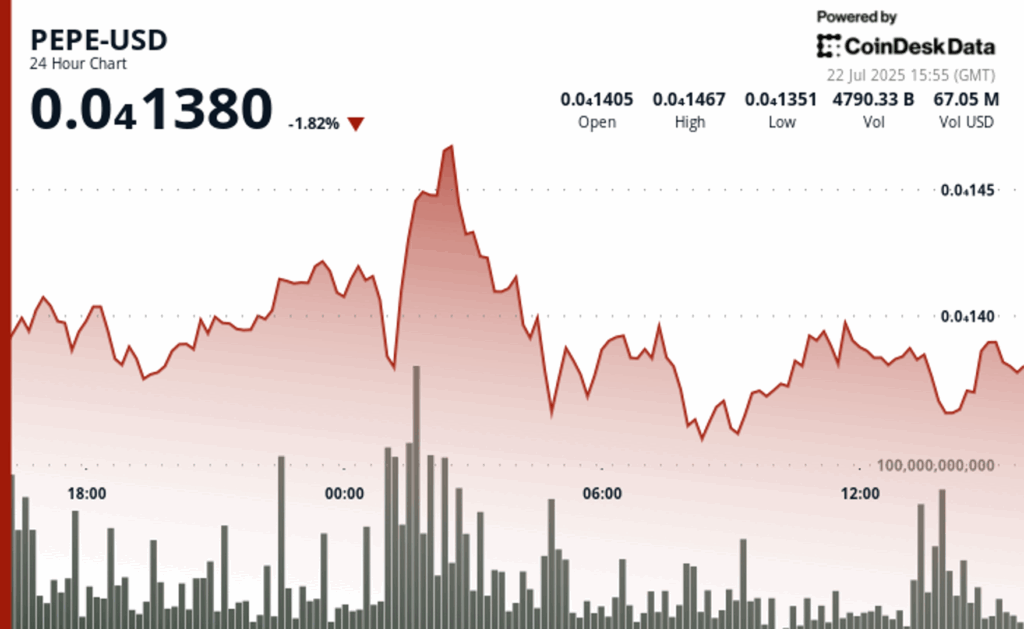

Pepe fell around 2% in the last 24 -hour period as part of a 5% broader sale that began in the middle of a slowdown in the cryptography market and a high -volume sales wave.

The price slid from $ 0.000014268 to $ 0.000013568 during the session, with 349 billion tokens downloaded during the movement, according to the technical analysis data model of Coindesk Research.

The cryptocurrency inspired by Meme briefly joined a session of $ 0.000014713, backed by 11.7 billion tokens that are negotiated in a single increase. But the attempt failed, finding strong resistance and causing a quick investment. The acute movement led to more than $ 4 million in liquidations, according to cancer data.

That highest session is now erected as a firm technical roof, reinforcing the doubts of the operators about the short -term rise. The relative subsequent volume on social networks has increased more than 23% compared to its average of 24 hours, according to Thetie data, which suggests a growing interest.

The support took place about $ 0.000013618, where buyers showed interest during the previous falls. While the Token moved briefly below that level, since then he has recovered to overcome it.

Meanwhile, Nansen’s data show that even when the 100 main directions that Pepe have in Ethereum have increased their holdings by 0.11%, exchange wallets added 0.24% in the last 24 hours, showing a growing supply in the market.

Despite the fall, Pepe has a slightly surpassed performance by the broader memecoin space. The memecoin index of Coindesk (CDMEME) saw a 2.4% drop in the last 24 hours, compared to the fall of Pepe about 2%. During the last month, Pepe increases almost 55% compared to the 41.7% increase in CDMEme.

The token with frog theme has overcome after forming a patron of the golden cross earlier this month. The Lark Davis cryptographic analyst on social networks marked a potential rupture objective at $ 0.0000155.

General description of the technical analysis

- The negotiation volume increased to 11.72 billion tokens during an attempt to break, indicating a generalized market participation.

- The strong rejection of $ 0.000014713 now serves as a critical roof for greater rise.

- The activity of the consistent buyer formed a key support about $ 0.000013618

- A strong deterioration began with 230.19 billion files sold in a concentrated period.

- The mass discharge occurred in successive waves of 237.67 billion, 329.19 billion and finally 349.11 billion tokens. The activity decreased almost zero, pointing out the fatigue of the merchant and the lack of conviction for recovery.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.