The controversial Bitcoin Treasury strategy of Michael Saylor is no longer marginal, it is being imitated throughout corporate America. According to a recent report by the Wall Street Journal, companies have raised more than $ 85 billion in 2025 to buy cryptocurrencies for their corporate treasure bonds, more than double the amount raised in the US opi. UU. This year.

Unlike 2020, when Saylor de Microstrategy was alone in the sale of shares to buy Bitcoin, a new wave of companies, from toy manufacturers to semiconductor companies, is executing similar strategies with institutional support. Capital Group, Galaxy Digital and D1 Capital are among companies that invest effective in companies that collect funds to accumulate digital assets directly. The increase has spread beyond Bitcoin to include less known tokens, often with higher risk reward profiles.

One of the most prominent examples is Hyperliquid Strategies Inc. (HSI), a public cryptographic treasury company that is being formed to celebrate great exaggeration reserves, the native token of the hyperlycide block chain.

How Hsi was created: Atlas and the sonnet join forces

The HSI initiative was disclosed on July 14, when Sonnet Biotherapeutics (Nasdaq: SonN) announced an reverse fusion with Rorschach I LLC, a recently formed entity backed by Atlas Merchant Capital, Paradigm and other prominent investors. The transaction will transform the sonnet into a vehicle for a corporate cryptographic treasury strategy focused on exaggeration.

When closing, the combined entity will be called Hyperliquid Strategies Inc. (HSI) and will continue to operate in the Nasdaq capital market. Initially, HSI will have 12.6 million exaggerated tokens, valued at $ 583 million at the time of the firm. It will also assign at least $ 305 million in additional capital to acquire more exaggeration in the open market, creating one of the largest Altcoin Treasury bonds.

Sonnet will continue to be a total property subsidiary of HSI, maintaining its R&D of Biotechnology in parallel. Investors will receive contingent value rights (CVR) linked to the performance of the Sonnet therapeutic pipe.

The HSI Board will be chaired by Bob Diamond, former CEO of Barclays and co -founder of Atlas Merchant Capital. Eric Rosengren, former president of the Boston Federal Reserve, is expected to join. The agreement is supported by Galaxy Digital, Panther Capital, D1 Capital, Digital Republic and 683 Capital, and is scheduled to close in the second half of 2025.

What is hyperlichid and how does the exaggerated token work?

Hyperliquid is the name of a decentralized exchange (DEX) and a high-performance layer-1 block chain launched in 2023. It was designed to offer the speed and commercial experience of centralized exchanges with transparency and access without permission of decentralized finances (Defi).

Its infrastructure includes two main layers:

- Hypercore, which drives high -speed futures and perpetual futures with chain order books, which supports more than 200,000 orders per second.

- Hyperevm, a general intelligent contract layer compatible with Ethereum, which allows developers to create applications that they can interact with Hypercore’s liquidity.

Hype is the native token of the hyperlichid ecosystem. It is used to bet, govern, commercial incentives and as the central asset for the capture of value in the network. At the time of writing this article, Hype is the largest cryptocurrency decimoctava for market capitalization and hyperliquido has processed more than $ 1 billion in volume of cumulative negotiation.

Analyst comment: solid foundations, divergent opinions

The increase in institutional care has not resolved the debate on the assessment of Hype, despite its strong rally at the beginning of this quarter of a minimum of $ 37.41 to almost $ 50 (reached on July 14).

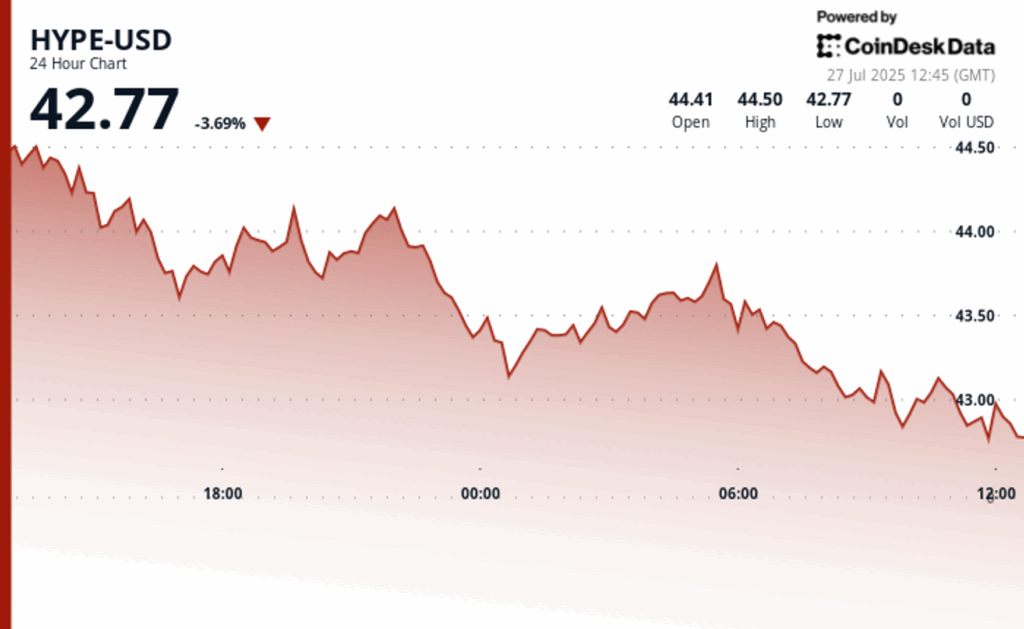

At the time of writing, according to Coindesk data, Hype is quoted at $ 42.77, 3.69% in the last 24 -hour period.

The cryptographic analyst “McKenna” suggested on Saturday that exaggeration can still be undervalued based on income metrics. He estimated that if the Token was quoted in the same valuation of valuation (known as SWPE, or price on sales weighted in sales) reached during its last market peak, its current average income of 30 days of $ 3.2 million would imply a fair price of $ 77. Its analysis uses a relationship that compared the market limit with the income of the final platform, a common method in both the analysis of equity and in the token.

On the contrary, “Altcoin Sherpa” said caution today. Although Hype’s foundations praised, including the high activity of the user, the reliable tokenomics and the strong execution of the team, he declared that the movement from $ 9 to more than $ 40 probably exhausted the rise in the short term. He said he was maintaining a small rethinking position for long -term exposure, but did not actively accumulate current prices. He suggested that he would expect a more substantial setback before increasing his assignment.

The two points of view illustrate a key tension: even with high income and institutional support, the chips such as exaggeration can be too widespread in the short term, especially when driven by the narrative impulse and speculative capital.

The institutional bets of Altcoin just begin

Whether the hype continues to climb or cools from here, the creation of Hyperliquid Strategies Inc (HSI) marks a turning point in how corporate cryptographic treasury strategies are executed. Unlike the previous models that focused on Bitcoin as a digital reserve asset, HSI is being built around a single alternative that did not exist a year ago. With more than $ 888 million in combined token and effective commitments, the structure resembles a thematic cryptographic fund, but with a public list and institutional leadership.

If this approach is successful, they can follow more companies: increase capital not only to maintain cryptography, but to take concentrated positions that believe it will define the next phase of digital finances.