XRP posted modest profits despite intradic volatility, recovering from early minimums to close about $ 3.22 in strong afternoon volumes. Institutional accumulation and a late session rally hint the Upside continuation.

What to know

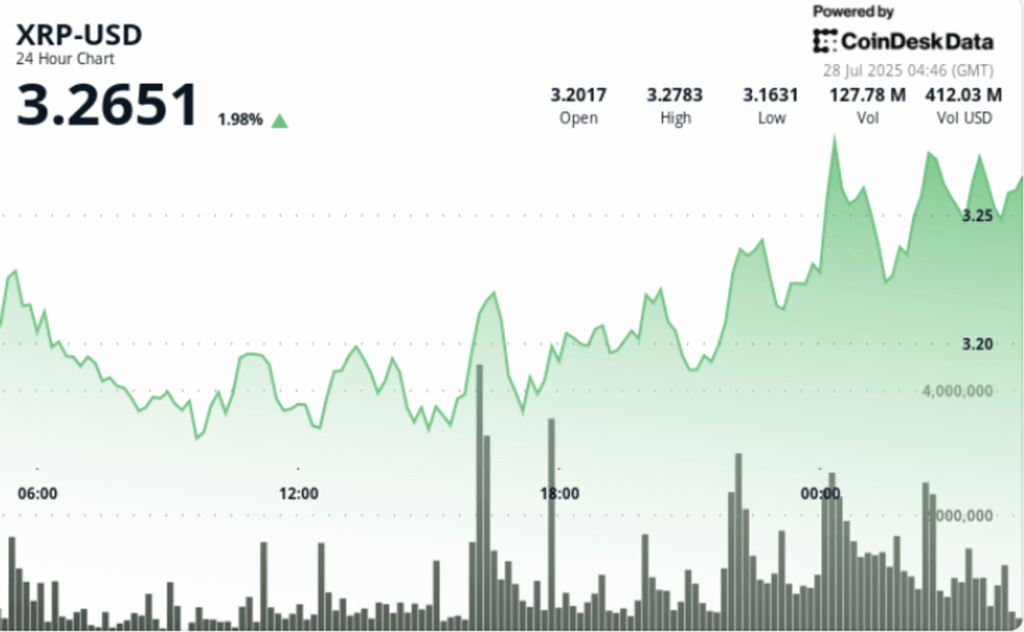

XRP advanced 1.3% during the 24 -hour period that ended on July 27 at 8:00 p.m., quoting between a minimum of $ 3.15 and a maximum of $ 3.23. The Token fell to $ 3.16 at the beginning of the session, but was abruptly recovered from strong purchase interests. A Rally of the late session was added to the bullish impulse when XRP settled near the top of its range, which suggests a short -term force that is directed to the next commercial window.

News history

Market conditions remained uncertain as cryptographic feeling continues to digest the recent volatility and liquidation activity related to ETF. Despite this, XRP showed signs of technical resilience, backed by institutional purchasing pressure signs. The widest narratives around the usefulness of XRP in cross -border payments and the integration of the DEFI continue to support long -term interests.

Summary of the price action

• XRP decreased to $ 3.16 around 09:00 before reversing higher

• The afternoon session saw volumes at 81.78my 69.06th 16:00 and 17:00, well above the 24 -hour average of 38.25m

• The Token quoted in a narrow range of $ 0.07, or a differential of 2.17%, between $ 3.15 and $ 3.23

• Final time rally XRP raised $ 3.21 to $ 3.22 with a strong volume at $ 3.20- $ 3.22 levels

• Support maintained a company at $ 3.16, with multiple successful reestimations during the day

Technical analysis

XRP formed a clean ascending channel throughout the session, with a series of minimums higher than $ 3.16 to $ 3.22. The resistance about $ 3.23 limited the profits, but the strong rebound of $ 3.20 at the final time showed impulse force. Volume peaks of 2.11ma at 20:02 and 1.97th 20:08 confirmed the institutional interest and accumulation patterns. XRP now needs to break and stay decisively above $ 3.23 to confirm a short -term bullish continuation.

What merchants are seeing

• Can XRP be kept above $ 3.20 in the middle of a broader market consolidation?

• Will the monitoring volume arise to test the range of $ 3.25– $ 3.30?

• Institutional entries remain key as the volumes of points increase above the average in the recovery phases

• Ocular Confirmation of Technical Merchants of the Rupture of the Ascending Channel to $ 3.30+