As the actions in the Nasdaq Listed (MSTR) strategy continue to lose ground, the demand for downward protection in the Bitcoins retention company has reached stronger in months.

On Wednesday, the one -year -old bias, the difference in implicit volatility between the call options and the sale that expires in 12 months, is 3.6%, the highest since April 17, according to the Data Source Market Chameleon market.

In other words, the demand for sale options, which offer protection against price losses, in relation to calls, is now stronger in more than three months.

AI Take

An IV extension of calls from ascending calos means that the implicit volatility of sale options (which benefits whether the price of the shares falls) is increasing much faster, or is significantly greater than the implicit volatility of Purchase options (What benefit if the price of the shares increases). This suggests that option merchants are willing to pay a much higher premium for downward protection or are betting more aggressively in a decrease in the price of Mstr shares.

It reflects a growing apprehension or a feeling of bassist among options for MSTR’s future performance during the next year. They are fixations in a greater probability of a significant fall in the stock.

A sales option gives the buyer the right, but not the obligation, to sell the underlying asset, MSTR, at a predetermined price at a later or before date. A buyer Put is implicitly bassist in the market, while a call buyer is optimistic.

Mstr is the largest head of Bitcoin in the world’s public list, with a tire of 628,791 BTC ($ 74.7 billion). The company has been buying BTC aggressively as an asset of the balance for five years in a trend movement for companies around the world.

However, the price of its shares has been fighting lately. Mstr has fallen by more than 14% to $ 292 in two weeks, closing just below the single mobile (SMA) of 50 days on Wednesday.

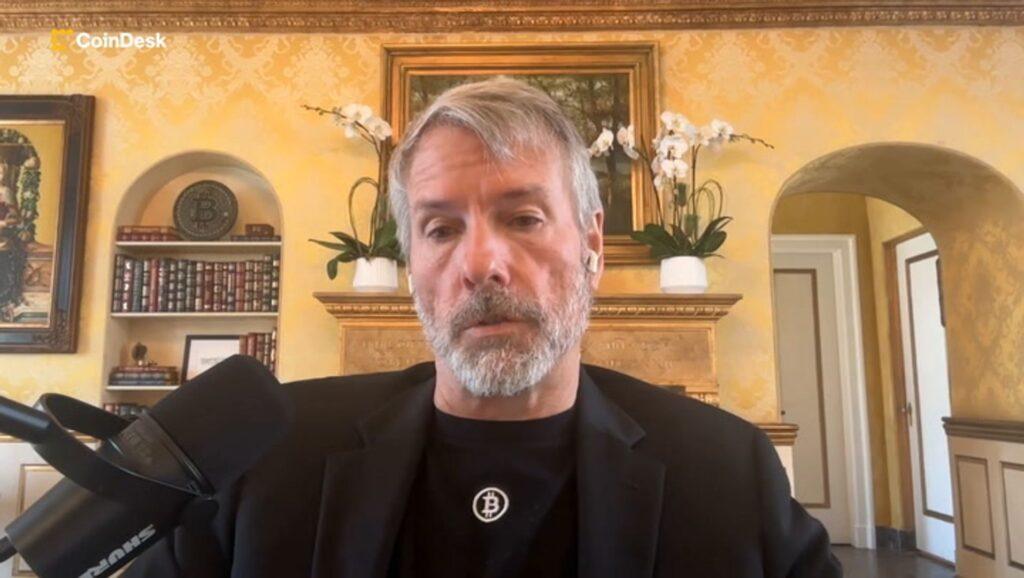

Correct (July 31, 08:30 UTC): Correct the company’s name to the strategy at all times. An earlier version of this story used with the old name, Microstrategy. Replace the image of the lead.